Copyright ©

2026 Jamison Private Wealth Management. All Rights Reserved. Privacy Policy Website by ChatmossWeb

A Guide to a Safe Withdrawal Rate Retirement Strategy

A Guide to a Safe Withdrawal Rate Retirement Strategy

Posted January 13, 2026

Defining Your Retirement Income Strategy

For the families we serve in Alpharetta, Roswell, and across North Georgia, retirement marks a profound transition. The years of disciplined saving and investing have culminated in this moment. The central question becomes, "How much can we safely spend each year without compromising our principal or legacy goals?"

This is the core of determining a safe withdrawal rate. It is not a universal number but a personal calculation, tailored to your family’s specific circumstances, objectives, and tolerance for risk. A durable income plan is founded on clarity, not just a percentage.

Beyond a Single Number

A generic rule of thumb is insufficient for sophisticated planning. It cannot account for the many variables that determine the longevity of a portfolio. A resilient retirement income plan must be built with a comprehensive view of several key factors:

- Your Desired Lifestyle: The plan must be designed to fund the life you envision.

- Market Volatility: The sequence of market returns, particularly in the years immediately following retirement, can significantly impact your portfolio's sustainability.

- Longevity and Healthcare: Planning for a retirement that could extend 30 years or more requires a thoughtful and conservative approach.

- Tax Efficiency: The strategy for withdrawing funds from different account types—taxable, tax-deferred, and tax-free—can dramatically alter your net spendable income.

The objective is to move from a theoretical percentage to a practical, resilient strategy. It’s about building a plan that can adapt to life and market dynamics while remaining aligned with your family’s core values.

This process is the bedrock of responsible wealth management and is central to our work as fiduciary advisors. An effective plan begins with understanding what a fiduciary wealth advisor actually does and why it matters.

Throughout this guide, we will examine the origins of concepts like the 4% rule and explain why a more personalized, dynamic approach is critical for high-net-worth families and business owners. Our goal is to bring clarity to this complex topic, helping you build a lasting plan that protects your lifestyle and preserves your legacy.

Understanding the 4% Rule and Its Modern Limits

For decades, the “4% rule” was the standard answer to retirement’s most pressing question: "How much can I safely spend?" The concept was straightforward: withdraw 4% of your portfolio in the first year of retirement, then adjust that dollar amount annually for inflation.

The rule offered a sense of certainty, derived from historical data suggesting a high probability of preserving capital over a 30-year period. It provided a clear, accessible starting point.

However, a guideline established in a different economic era is not a reliable strategy for today. For the families we advise in Alpharetta and across Fulton County, relying on this single data point can introduce unforeseen risks.

Why a Static Rule Faces New Challenges

The economic environment that supported the 4% rule has changed. Previous assumptions—including higher bond yields, predictable inflation, and shorter retirements—no longer hold true. As fiduciaries, our responsibility is to develop plans for the current economic reality, not one from decades past.

Several factors make a static rule a precarious oversimplification:

- Lower Expected Returns: Current bond yields are significantly lower than their historical averages, placing a drag on the income a balanced portfolio can reliably generate.

- Increased Longevity: Retirements that last 30, 40, or even 50 years are now common, placing far greater demands on assets.

- Market Valuations: Retiring at a market peak can create vulnerability to a significant downturn precisely when withdrawals begin.

A retirement income plan should be built on a foundation of current economic realities and personalized objectives, not just historical averages. A static percentage fails to adapt, while your life and the markets constantly do.

The Critical Impact of Sequence of Returns Risk

The primary weakness of any fixed withdrawal strategy is its vulnerability to sequence of returns risk. This is a subtle but potent threat to portfolio longevity. It is the danger that a significant market decline in the early years of retirement causes permanent capital impairment.

When markets fall shortly after retirement, you are forced to sell assets at depressed prices to fund living expenses. This means selling more shares to generate the same amount of cash, permanently depleting the asset base needed for recovery and future growth.

Another individual with an identical portfolio might retire into a bull market and see their assets appreciate, even while taking withdrawals. The only variable was timing—but that timing can be the difference between a secure retirement and the premature depletion of assets.

This is why a rigid, inflexible approach is no longer sufficient. Your objective is not merely to survive a historical worst-case scenario; it is to build a resilient strategy for your future. As you explore more about these withdrawal rate methodologies, you'll see the goal can range from simply spending down your portfolio to preserving your principal forever.

Redefining a Truly Safe Withdrawal Rate

There is no single, universal safe retirement withdrawal rate. The answer is not found in a historical study, but in a comprehensive plan that reflects your family’s unique financial position, goals, and the economic realities of today.

For the high-net-worth households we serve, the variables are more pronounced. A generic rule of thumb is inadequate. A resilient retirement income strategy must be built on a framework that integrates all relevant factors, moving beyond a simple percentage to a sophisticated, adaptive plan.

The Real Variables That Matter

To create a sustainable income stream, we must consider the complete picture. Four factors, in particular, can dramatically alter the viability of any retirement plan.

- Longevity: It is not uncommon for retirements to last 30, 40, or even 50 years today. A plan that appears sound over a shorter duration can become stressed when extended over a longer lifespan.

- Inflation: Even modest inflation steadily erodes purchasing power. Your withdrawal strategy must be designed to grow, ensuring your income keeps pace with rising costs.

- Taxes: The source of your income—from taxable, tax-deferred, or tax-free accounts—has a significant impact on your net spendable assets. A tax-aware withdrawal sequence can extend portfolio longevity by years.

- Healthcare Costs: These expenses are a major variable for retirees and often rise unpredictably in later life. Your plan needs the flexibility to address them.

These factors are interconnected, creating a complex web of risks and opportunities that a simple rule cannot navigate.

How Your Portfolio and the Market Change the Math

Beyond personal circumstances, your portfolio's structure and the market environment play a decisive role. Your asset allocation directly influences both growth potential and vulnerability to a downturn—especially at the start of retirement.

Modern research continues to refine this guidance. For instance, a recent analysis from Morningstar concluded that 3.9% is the highest safe starting withdrawal rate for retirees seeking consistent, inflation-adjusted spending over 30 years with a 90% probability of success. That figure applies to portfolios with an equity allocation between 30% and 50%. Interestingly, the research showed that holding more equities can sometimes reduce the safe withdrawal rate due to increased volatility.

A successful withdrawal strategy is not about finding the perfect starting number. It is about building a flexible framework that can adapt to market performance and your evolving needs over decades.

The table below illustrates how different factors can shift a withdrawal strategy from a static rule to a dynamic plan.

Impact of Key Variables on Retirement Withdrawal Strategy

This table shows how different personal and economic factors can influence the sustainability of a retirement income plan, moving beyond a single withdrawal rate.

| Factor | Potential Impact on Withdrawal Strategy | Strategic Consideration |

|---|---|---|

| Increased Longevity | A lower initial withdrawal rate may be necessary to sustain income over a longer period. | Stress-test the plan for a 40+ year retirement. Consider annuities or other longevity-hedging tools. |

| High Inflation | Erodes purchasing power, requiring withdrawals to increase faster than planned. | Allocate to assets with inflation protection (e.g., TIPS, real estate, equities). Build flexibility for non-essential spending cuts. |

| High Tax Burden | Reduces net spendable income, effectively lowering the "safe" withdrawal rate. | Implement a tax-aware withdrawal sequence, drawing from taxable, tax-deferred, and tax-free accounts strategically. |

| Market Volatility | A market downturn early in retirement (sequence risk) can permanently impair the portfolio. | Employ dynamic withdrawal rules (e.g., guardrails) that reduce withdrawals during down markets. |

| Unexpected Expenses | Large, unplanned costs like healthcare can force higher-than-ideal withdrawals. | Set aside a dedicated liquidity buffer or use insurance (e.g., long-term care) to cover specific risks. |

This highlights why a one-size-fits-all approach is so risky. A strategy suitable for one family could be entirely inappropriate for another.

For families in Alpharetta, Marietta, and throughout North Georgia, our role is to transform a generic guideline into your personalized strategy. Understanding these influencing factors is the first step toward creating a resilient income stream that provides confidence and clarity for the future. This thoughtful approach elevates a simple calculation into a cornerstone of your family’s long-term financial security.

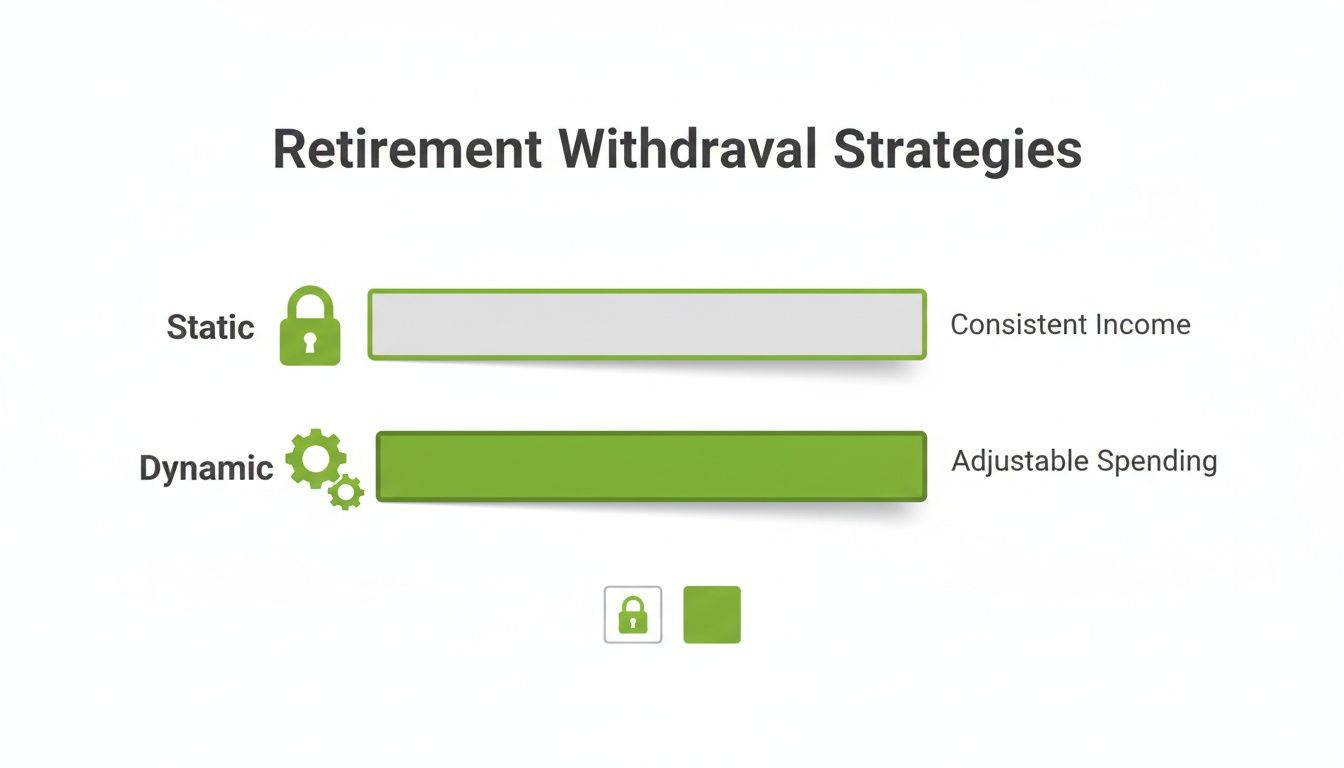

Implementing Dynamic Withdrawal Strategies

A fixed withdrawal percentage feels simple, but it ignores a fundamental reality: markets are not linear, and life is rarely predictable. This is why a static number can be so precarious.

A more resilient plan must be responsive and adaptive.

This is the principle behind dynamic withdrawal strategies. Instead of being locked into a single number, your income adjustments are guided by a clear set of rules tied directly to your portfolio's performance. It is a structured methodology for managing volatility without derailing your long-term objectives.

For the business owners and families we work with from Johns Creek to Cumming, this approach builds genuine confidence. The plan is designed to endure, not merely hope for favorable conditions.

The Guardrail Approach to Retirement Income

One of the most effective dynamic models is the "guardrail" strategy. Imagine driving on a winding road; the guardrails are there to keep you safely on course. Your financial plan requires similar boundaries.

This strategy establishes upper and lower thresholds for your portfolio's value that trigger specific, predetermined actions. This is how it works:

- The Lower Guardrail: If a market downturn causes your portfolio to fall below a certain level, your withdrawals are automatically reduced by a set percentage (e.g., 10%). This simple adjustment prevents you from selling an excessive number of assets at low prices, preserving capital for the eventual recovery.

- The Upper Guardrail: Conversely, when strong markets push your portfolio's value above the upper threshold, you can provide yourself with an income increase. This allows you to participate in your portfolio's success when conditions are favorable.

The rules are established in advance, removing emotion from the decision-making process when markets are turbulent. It provides a clear, logical path forward.

A dynamic withdrawal strategy transforms retirement income planning from a single, static decision into an ongoing, disciplined process. It is the difference between a brittle plan that can snap under pressure and a resilient one that is built to flex.

Beyond Guardrails: Other Flexible Models

While the guardrail approach is a powerful framework, other flexible strategies can be tailored to a family’s specific goals and risk tolerance.

Some models are simpler. For example, your withdrawal could be tied directly to the previous year's performance. If your portfolio returned 8%, your withdrawal for the current year would be based on that new, higher balance. This keeps your spending aligned with your portfolio's real-time capacity.

Another method is to forgo the inflation adjustment in years following a negative market return. It is a small, temporary sacrifice in purchasing power that can give your portfolio the necessary breathing room to recover, significantly improving its long-term viability.

The key is that these are not reactive, panicked decisions. They are proactive adjustments built into a long-term plan—a crucial distinction from an outdated approach. As we often discuss with clients, understanding why a set-it-and-forget-it approach is not a real financial strategy is fundamental to responsible wealth stewardship. The goal is to create a sustainable income stream that can withstand market cycles while providing the clarity you need to live confidently.

Stress-Testing Your Retirement Plan with Scenario Analysis

A financial plan is only as strong as its ability to handle unforeseen circumstances. We believe in rigorously stress-testing every retirement income strategy to evaluate its resilience under a variety of real-world conditions. This process is not about predicting the future; it is about building a plan that is resilient by design.

This analysis helps the families we advise, from Alpharetta to Dahlonega, answer the critical "what if" questions. How would the plan perform if a severe bear market occurred immediately after retirement? How would spending power be affected if inflation remained elevated for an extended period? Answering these questions builds durable confidence.

The Power of Monte Carlo Simulations

To find these answers, we utilize sophisticated tools like Monte Carlo simulations. Instead of projecting a single, linear path into the future, this analysis runs your plan through thousands of different potential outcomes, each with a unique sequence of market returns and inflation rates.

The result is not a single, definitive number, but a probability. For example, a simulation might indicate a 95% probability that your assets will last through a 35-year retirement at your planned spending level. This provides a clear, data-driven perspective on the risks involved and helps us incorporate appropriate safeguards. Understanding these potential outcomes is a key step in reducing financial uncertainty and the hidden costs it creates.

Identifying Vulnerabilities Before They Emerge

Stress-testing a withdrawal strategy is about preparing for a wide range of possibilities, not predicting a single outcome. By running these scenarios, we can identify potential weaknesses in a plan long before a crisis occurs, allowing for prudent adjustments in advance.

The goal of scenario analysis is to build a retirement income plan that is resilient by design. It replaces hope with a structured, analytical framework, which is a cornerstone of our fiduciary duty to every client.

The infographic below illustrates the core difference between a rigid, static plan and an adaptive, dynamic one.

As you can see, a dynamic approach allows for adjustments based on actual market behavior, giving it far greater sustainability than a fixed rule that remains unchanged regardless of conditions.

A Historical Perspective on Safe Withdrawal Rates

History provides crucial context. Retrospectively, the maximum sustainable withdrawal rate has varied significantly depending on the decade one retired. One comprehensive study showed that in certain periods, retirees could have initiated withdrawals as high as 10.75%.

However, other, more conservative studies seeking a truly "safe" rate—one that would have survived even the most challenging market periods for 50 years or more—arrive at a much lower figure, closer to 3% to 3.5%.

This is precisely why we stress-test. A plan should not be based on a single historical average or a best-case scenario. It must be built on a deep understanding of market behavior over time, ensuring your strategy is built to last.

Integrating Your Withdrawal Rate into a Comprehensive Plan

A safe withdrawal rate is not an isolated calculation performed once and then archived. It is a single component of a much larger, interconnected financial framework.

For the families we serve across North Georgia, from Canton to Kennesaw, a successful retirement is built on a strategy that coordinates income needs with tax planning, estate considerations, and risk management. True financial clarity is not found in a single percentage, but in the harmonious integration of all these elements.

The objective is to create a seamless plan where your investment strategy supports your income needs, your income strategy is tax-efficient, and your entire financial structure aligns with your long-term legacy goals.

Beyond the Withdrawal Percentage

The location of your assets—whether in taxable, tax-deferred, or tax-free accounts—is as important as their total value. This "asset location" heavily influences the optimal strategy for drawing income.

In some years, it may be more advantageous to draw from a taxable brokerage account. In others, taking a distribution from a traditional IRA—and triggering ordinary income tax—might be an inefficient choice.

A carefully structured, tax-aware withdrawal sequence can significantly extend the longevity of your portfolio. While this image's content is not available, financial professionals can offer further insights on integrating tax considerations into your retirement plan, as this coordination is vital for preserving your wealth.

A withdrawal rate is simply a tool. The real strategy lies in how that tool is integrated with every other part of your financial life, from tax planning to your ultimate legacy.

Aligning Income with Your Family’s Legacy

Your retirement income strategy has a direct impact on your estate. The decisions you make today about which accounts to draw from first will affect what remains for your heirs and how those assets are ultimately taxed.

A plan designed solely to provide income, without considering its effect on your legacy, is incomplete.

This integrated approach is the core of our work as fiduciary advisors. We focus on connecting the key areas of your financial life:

- Investment Management: Building a portfolio designed to support your required withdrawals while managing risk.

- Retirement Income Planning: Structuring a tax-efficient and sustainable distribution stream.

- Estate and Legacy Coordination: Ensuring your income strategy aligns with your long-term wishes for your family and charitable interests.

By bringing these elements together, we move beyond calculating a number to building a comprehensive plan designed to provide confidence and clarity for the decades ahead.

Your Questions About Safe Withdrawal Rates, Answered

We have moved from historical rules of thumb to the dynamic strategies necessary for today’s retirement landscape. Here are answers to the most common questions our clients ask as they prepare for this important chapter.

Does the 4% Rule Still Work for Retirement Planning?

The 4% rule is best viewed as a historical benchmark. It provides a useful reference point, but it was developed based on market conditions and shorter retirement assumptions that are different from today's environment.

For many individuals retiring now, a fixed 4% withdrawal rate may be too aggressive. Longer life expectancies and a different economic landscape often call for a more conservative starting point. A sound plan does not rely on a single number; it stress-tests the initial rate and incorporates the flexibility to adapt.

How Does Sequence of Returns Risk Affect My Retirement?

This is one of the most critical yet least understood risks in retirement. Sequence of returns risk is the danger of experiencing poor market returns in the first few years after you cease working.

The timing is crucial because you are selling assets to generate income precisely when their values are depressed. This erodes a disproportionate share of your portfolio, leaving a smaller capital base from which to recover when the market eventually improves.

A portfolio that benefits from strong returns early in retirement can withstand far more stress than one that encounters a bear market at the outset. This single variable is why rigid, fixed withdrawal plans can be so fragile.

What Is a Dynamic Withdrawal Strategy?

A static strategy, like the classic 4% rule, is indifferent to market conditions. It prescribes the same inflation-adjusted withdrawal whether your portfolio is up 20% or down 20%. That rigidity is its greatest weakness.

A dynamic strategy, by contrast, is designed to be responsive. It adjusts your withdrawals based on a set of pre-agreed rules tied to your portfolio's actual performance.

For example, a "guardrail" strategy might automatically reduce withdrawals by a small percentage if your portfolio value dips below a certain threshold. Conversely, it might allow for a supplemental distribution after a year of strong growth. The goal is to protect your capital when it is most vulnerable and allow you to benefit from favorable years.

A dynamic strategy isn’t about emotional market reactions. It’s about responding to changing conditions with a disciplined, pre-determined plan.

Why Is a Personalized Approach Important for High-Net-Worth Families?

A simple rule of thumb is insufficient for managing financial complexity. High-net-worth families often navigate multiple income streams, sophisticated tax situations, and multi-generational goals.

A generic formula cannot account for these variables. A truly personalized approach is designed to:

- Create a tax-aware withdrawal plan, sourcing funds from taxable, tax-deferred, and tax-free accounts in the most efficient order.

- Integrate the income strategy with the family’s broader estate and legacy objectives, ensuring wealth is preserved for future generations.

- Structure the plan to manage the irregular cash flows common for business owners and executives with equity compensation.

It is the difference between a simple calculation and a comprehensive strategy built for the long term. This is the detailed, coordinated planning we provide for families in Alpharetta, Milton, and across North Georgia.

Navigating the complexities of retirement income requires a strategy as unique as your family. At Jamison Wealth Management, we provide the fiduciary guidance and comprehensive planning needed to build a resilient and lasting financial future. To explore whether our approach aligns with your goals, we invite you to schedule a confidential conversation.

Speak with a Jamison Wealth advisor

Transitioning from asset accumulation to creating a reliable income stream is one of the most significant financial shifts a family will navigate. For years, the objective was growth. Now, the focus is on stewardship and ensuring your wealth provides for your family, potentially for decades. This guide explores the principles of a safe withdrawal rate…