Copyright ©

2026 Jamison Private Wealth Management. All Rights Reserved. Privacy Policy Website by ChatmossWeb

Sophisticated Social Security Claiming Strategies for High-Net-Worth Families

Sophisticated Social Security Claiming Strategies for High-Net-Worth Families

Posted January 13, 2026

The Role of Social Security in a Comprehensive Wealth Strategy

While many view Social Security as a safety net, for those with significant assets, it represents something else entirely: a unique, inflation-adjusted annuity guaranteed by the U.S. government.

When integrated properly into your broader financial picture, it enhances stability and creates opportunities for tax and legacy planning. A sound approach does not look at this income stream in isolation but as a foundational piece of a comprehensive wealth strategy.

The core objective is not merely to secure the largest monthly payment. It is about optimizing your entire financial position for the long term. This requires balancing a few critical factors:

- Portfolio Longevity: Delaying Social Security provides a larger, guaranteed income stream. This can reduce the amount you need to withdraw from your investment portfolio, particularly during market downturns, helping to preserve your capital for growth and legacy objectives.

- Tax Efficiency: Your claiming decision directly impacts your taxable income. A coordinated strategy can help manage your tax bracket in retirement, potentially lowering your lifetime tax liability and minimizing the impact on Medicare premiums.

- Spousal and Survivor Security: For married couples, the higher earner's claiming decision sets the foundation for the surviving spouse's future income. Making a strategic choice here is a powerful act of stewardship for your family.

Viewing Social Security as a distinct asset class allows for more intentional planning. Its guaranteed nature provides a counterbalance to market-based assets, offering a layer of stability that is difficult to replicate.

Ultimately, the goal is to make a decision that aligns with your family’s specific circumstances—from health and longevity expectations to your vision for the future. To manage risk and support the long-term growth of a high-net-worth portfolio, it is also wise to explore robust strategies on how to diversify your investment portfolio, which complement a solid Social Security plan.

For families in North Georgia, from Alpharetta to Dahlonega, this process is best guided by a trusted advisor. This is a key area where understanding what a fiduciary wealth advisor actually does becomes invaluable in making confident, informed choices.

The timing of your Social Security claim is one of the most significant financial decisions you will make. It is not just about when payments begin; it is a strategic choice that impacts your entire retirement plan. For a high-net-worth family, this represents the optimization of a core, inflation-protected asset designed to provide support for decades.

Let's examine the three main timing options: claiming as early as possible (age 62), waiting for your Full Retirement Age (FRA), or holding out for the maximum benefit at age 70. Each path has trade-offs that affect your portfolio, your tax plan, and your spouse's financial security.

Claiming Early at Age 62

The earliest you can start benefits is age 62, and the appeal is clear: immediate cash flow. This can be useful if you wish to retire before your FRA, providing liquidity without needing to sell investments, especially in a down market.

However, this convenience comes at a permanent cost. If your Full Retirement Age is 67, claiming at 62 means your monthly benefit is reduced by 30%. That reduction is locked in for life. It also diminishes the potential survivor benefit your spouse would receive. While the immediate income is tempting, it must be weighed against forgoing a much larger, guaranteed payment stream for the rest of your life.

Claiming at Full Retirement Age

Your Full Retirement Age is the point at which you are entitled to 100% of your primary insurance amount (PIA). Depending on your birth year, this is between age 66 and 67. Claiming at FRA is a common, balanced strategy. You avoid the penalty for claiming early but are not required to wait any longer.

This option provides your full, unreduced benefit, creating a solid income floor for your retirement. For many families in communities like Alpharetta and Roswell, aligning the start of Social Security with a planned retirement at FRA is a natural and sensible decision.

Delaying Until Age 70

This is where the strategic power of Social Security becomes most apparent. For every year you delay claiming past your FRA, your benefit grows by a guaranteed 8% due to Delayed Retirement Credits. These credits max out at age 70, making it the point of maximum payout.

If your FRA is 67, waiting until age 70 means your monthly check will be 124% of your full retirement amount. This strategy transforms Social Security into a powerful form of longevity insurance, delivering the highest possible guaranteed, inflation-adjusted income for life. For the higher-earning spouse, it is also a critical move for protecting a surviving partner, as it maximizes the benefit they would inherit.

Delaying your claim creates a larger, more resilient income floor. This can significantly reduce the pressure on your investment portfolio, allowing it to remain invested for long-term growth and legacy objectives, especially during periods of market volatility.

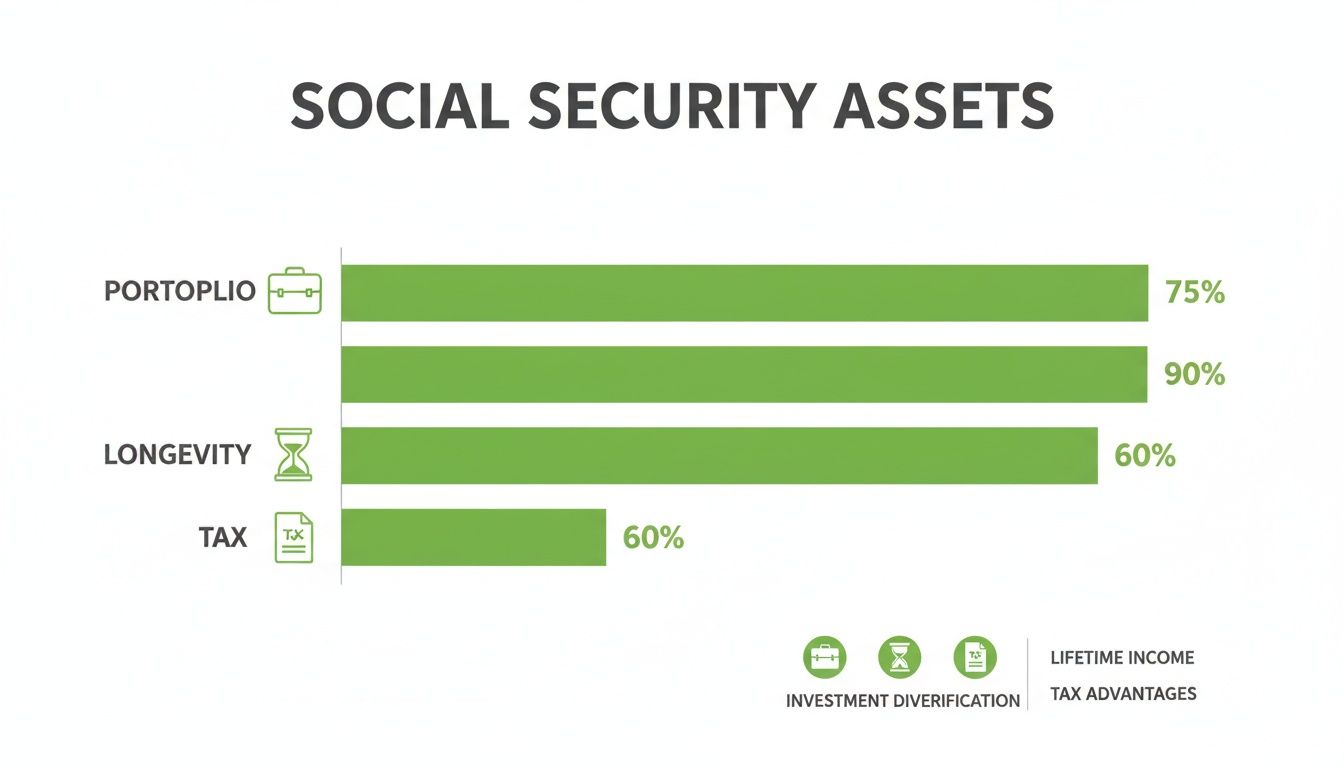

The chart below helps visualize Social Security not just as income, but as a foundational asset that directly impacts your portfolio, longevity plan, and tax strategy.

As you can see, an optimized claiming decision does more than just provide a check; it reinforces your entire financial structure for the decades ahead.

Despite the clear financial incentive for waiting, most people do not. A paradox exists where fewer than 10% of retirees wait until age 70, while nearly a third claim at 62. For an individual with an FRA of 67, delaying to 70 provides a 24% larger lifetime benefit. This gap between the optimal financial move and common behavior highlights a significant opportunity for strategic planning. You can explore these behavioral patterns in this analysis of Social Security filing strategies.

The table below provides a side-by-side look at how these decisions play out over time, helping to clarify the trade-offs involved.

Comparative Analysis of Social Security Claiming Ages

| Claiming Age | Benefit vs. FRA Amount | Annual Delayed Credit | Breakeven Age (Approx.) | Primary Strategic Consideration |

|---|---|---|---|---|

| Age 62 | 70-75% of FRA benefit | N/A (Benefit is reduced) | Late 70s | Provides immediate cash flow but locks in a permanently lower lifetime benefit. |

| FRA (66-67) | 100% of full benefit | 0% | N/A (Baseline) | A balanced approach that avoids penalties without requiring further delay. |

| Age 70 | 124-132% of FRA benefit | 8% per year past FRA | Early 80s | Maximizes guaranteed lifetime income, providing powerful longevity and survivor protection. |

Each path has a breakeven point—the age at which the total lifetime benefits from waiting catch up to and surpass the total from claiming early. However, the best choice is not merely a mathematical exercise. It is a personal decision based on your health, liquidity needs, and your family’s complete financial picture. A decision of this magnitude should be made with clarity and confidence, ensuring it aligns perfectly with your vision for the future.

Coordinated Strategies for Spouses and Survivors

For married couples, claiming Social Security is a collaborative decision. A choice made by one spouse can have significant financial implications for the other, particularly for the partner who may live longer. Creating a coordinated plan is one of the most powerful acts of financial stewardship a couple can undertake.

The objective is to maximize your total household income over a joint lifetime. Equally important is providing the strongest possible financial backstop for the surviving spouse. This means looking beyond individual breakeven points and focusing on the long-term family outcome.

The Power of Survivor Benefits

When one spouse passes away, the survivor is entitled to keep the higher of the two individual Social Security benefits. This single fact should serve as the anchor for every couple’s claiming strategy.

Crucially, the benefit the surviving spouse inherits includes any delayed retirement credits the deceased spouse earned.

Therefore, if the higher-earning spouse waits to claim until age 70, they are not just increasing their own monthly payment. They are essentially establishing a larger, lifelong, inflation-adjusted annuity for their partner, should that partner outlive them. This one decision can provide decades of financial stability.

For many families we work with in Alpharetta and Johns Creek, the survivor benefit is the cornerstone of their Social Security plan. It acts as a powerful form of longevity insurance that protects a family’s standard of living for the next generation.

This act of patience ensures the surviving spouse receives the maximum possible income stream, which can reduce the pressure to draw down other investment assets later in life.

Strategic Coordination for Couples

An optimal spousal strategy weighs several factors: age differences, health, longevity expectations, and each spouse's earnings history. For high-net-worth households, a few common approaches typically emerge as most effective.

- Maximize the Higher Benefit: This is often the most effective strategy. The higher-earning spouse delays claiming until age 70 to secure the maximum possible benefit. The lower-earning spouse might claim their own benefit earlier for cash flow or wait until their own Full Retirement Age. The end result is that the largest possible survivor benefit is secured for the future.

- The Spousal Benefit Claim: A lower-earning spouse may be eligible for a spousal benefit worth up to 50% of the higher earner's full retirement age benefit. The condition is that the higher earner must have already filed for their own benefits. This can be a useful tool for generating household income while allowing one or both benefits to continue growing.

These strategies are not mutually exclusive and can be blended. A couple might decide the lower earner will claim early to provide an income bridge, which allows the higher earner to delay and capture those valuable 8% annual credits.

The ultimate goal is to structure these government-guaranteed benefits to complement your broader wealth plan. These decisions reach far beyond a monthly check; they influence how you approach all your other financial goals.

When planned thoughtfully, Social Security coordination becomes a key component in a robust legacy plan—a core part of our approach to estate planning for high-net-worth families. A coordinated approach ensures Social Security serves its highest purpose for your family: providing lasting security and confidence.

Integrating Social Security with Your Tax and Investment Plan

Making a Social Security claiming decision in isolation is a significant missed opportunity in retirement planning. For the families and business owners we advise in Fulton County and Forsyth County, this is not a standalone choice. It is a critical piece of a much larger financial puzzle.

An effective strategy must work in concert with your investment portfolio, your tax plan, and even your Medicare premiums. The timing of your benefits can create powerful tax-planning openings or, if handled improperly, trigger unforeseen costs.

The goal is to view this decision through a wider lens, ensuring it supports your long-term goals for wealth preservation and your legacy.

Provisional Income and the Taxation of Benefits

Many are surprised to learn that their Social Security benefits can be taxable. The determining factor is a figure called provisional income. It is calculated by taking your modified adjusted gross income (MAGI), adding any tax-exempt interest, and then adding 50% of your annual Social Security benefits.

If that total crosses certain thresholds, up to 85% of your Social Security benefits can become taxable at your ordinary income rate. For affluent households, this is a central planning point. A poorly timed claim can easily push you into a higher tax bracket, increasing your lifetime tax liability.

Coordinating Portfolio Withdrawals and Social Security

The years between when you stop working and when you claim Social Security—often called the "bridge years"—are strategically vital. By delaying your benefits, you can intentionally keep your provisional income low during this period.

This opens up several strategic opportunities:

- Roth Conversions: Lower-income years are an ideal time to convert traditional IRA assets to a Roth IRA at a more favorable tax rate.

- Tax-Gain Harvesting: You can realize appreciated assets from your taxable investment accounts and potentially pay a 0% or 15% long-term capital gains tax.

- Strategic Withdrawals: You can fund your lifestyle by drawing from specific accounts, like a brokerage account or Roth IRA, without creating a substantial tax event.

The decision to delay Social Security is not just about receiving a larger payment later. It is about creating a window to execute tax-saving strategies that can add significant value to your net worth over the long term.

For business owners in communities like Cumming or Canton who are planning an exit, this coordination is even more critical. Aligning the timing of a business sale with a Social Security claim is essential to manage the income event from the sale while optimizing your retirement income.

The Connection to Medicare Premiums

Your income affects not only your taxes but also what you pay for Medicare Part B and Part D. Higher earners pay an Income-Related Monthly Adjustment Amount (IRMAA), which is a surcharge added to their standard premiums.

IRMAA is based on your MAGI from two years prior. A sudden spike in income from portfolio withdrawals, a business sale, or starting Social Security can trigger higher premiums. A coordinated claiming strategy helps manage your income so these costs remain predictable and controlled.

Finally, long-term policy adds another layer to the decision. The Social Security Board of Trustees projects that by 2035, ongoing tax revenues will cover only about 75-76% of scheduled benefits if Congress does not act. This potential for future changes is a factor we discuss with clients, balancing the clear mathematics of delaying against policy uncertainty. You can explore these projections further in the official SSA reports.

The abstract rules of Social Security become meaningful only when you see how they apply to real-life circumstances.

To make these claiming strategies more tangible, let's explore a few scenarios we often encounter with the families we serve across North Georgia. Each one demonstrates how a thoughtful, integrated plan is developed.

These examples are intended not as direct advice but as a blueprint for the kinds of conversations that lead to confident, well-reasoned decisions.

Scenario One: The Cumming Business Owner

A 62-year-old business owner in Cumming plans to sell his company in the next three to five years. His Social Security benefit at Full Retirement Age (FRA) is substantial, and he has built a healthy investment portfolio outside of his business.

A conventional approach might be to sell the business and immediately claim Social Security for retirement income. A more strategic approach, however, recognizes the unique planning opportunity in the gap between his exit and age 70.

The Strategic Approach:

Instead of claiming benefits immediately, he decides to wait until age 70. This accomplishes two critical objectives.

First, his benefit grows by a guaranteed 8% each year he delays past his FRA, maximizing a stable, inflation-adjusted income stream for life. Second, it creates a crucial "bridge" period where his taxable income is intentionally low.

During these years, he lives on a portion of the proceeds from his business sale and his taxable brokerage accounts. This low-income window allows for systematic Roth conversions from his large traditional IRA at a much more favorable tax rate than he would receive once Social Security and Required Minimum Distributions (RMDs) begin.

By aligning his business exit with a delayed Social Security claim, he transforms a one-time sale into a multi-year tax optimization strategy, helping to preserve more of his legacy for his family.

Scenario Two: The East Cobb Executive Couple

Consider a married couple in their early sixties from East Cobb, both high-earning executives. The husband, 64, has a significantly higher lifetime earnings record than his wife, who is 62. Both are in excellent health and have long life expectancies.

Their primary goal is to ensure the surviving spouse can maintain their standard of living without financial stress. This places the maximization of the survivor benefit at the center of their strategy.

The Coordinated Plan:

The optimal approach is for the husband—the higher earner—to delay claiming his benefit until age 70. This single decision secures the largest possible survivor benefit for his wife.

Meanwhile, his wife considers her own options. She could claim her own reduced benefit at 62 for additional cash flow, or she could wait until her FRA to receive her full benefit. Since their portfolio can comfortably cover their expenses, she decides to wait until at least her FRA as well.

This coordinated plan achieves two things: it maximizes their total household benefit if they both live long, and more importantly, it builds the strongest possible financial safety net for whoever lives longer.

Scenario Three: The Roswell Widow

Our final scenario involves a 63-year-old widow in Roswell. Her late husband was the primary earner and passed away before claiming Social Security. She has her own work history and a solid investment portfolio but is now navigating retirement income on her own.

She is eligible for two different benefits: her own retirement benefit and a survivor benefit based on her late husband's record. A critical—and often misunderstood—rule allows her to claim one without impacting the other.

The Survivor Optimization Strategy:

Her late husband's potential benefit is larger than her own. Her best approach is to claim her widow's survivor benefit now. This provides immediate, stable income to cover her living expenses.

At the same time, she lets her own retirement benefit remain untouched. It continues to grow, earning delayed retirement credits until she turns 70. At that point, she will switch from the survivor benefit to her own maximized retirement benefit, which will then be significantly larger.

This strategy allows her to use the survivor benefit as a financial bridge, protecting her investment portfolio from early withdrawals and maximizing her personal benefit for the long run. It turns a complex situation into a clear, confident path forward.

Building Your Personal Social Security Claiming Framework

A successful claiming strategy is not based solely on mathematics; it is deeply personal.

While the scenarios we have covered offer a blueprint, the right path for your family must be built on your specific circumstances and long-term goals. There is no single "correct" answer, only the one that aligns with your life.

This process goes far beyond simple breakeven calculations. It requires a structured conversation between you and your advisor to weigh the trade-offs with clarity. At Jamison Wealth Management, this is how we help families in our community, from Marietta to Dawsonville, make a confident decision that serves their long-term interests.

Core Questions to Guide Your Decision

To begin building your framework, we start with a few foundational questions. Your answers will shape the entire strategy, ensuring it reflects what truly matters to you and your spouse.

Consider these points in a planning discussion:

- What are your family's longevity expectations? An honest assessment of family health history and personal wellness is the starting point. Longer life expectancies almost always strengthen the case for delaying benefits to maximize lifetime income.

- How will you fund the "bridge" years? If you plan to delay Social Security, which assets will cover living expenses until then? The answer has significant tax and portfolio implications.

- What is your comfort level with market risk versus longevity risk? Delaying benefits provides a guaranteed, inflation-adjusted return—a powerful hedge against outliving your assets. Claiming early, on the other hand, might prevent selling investments in a down market.

- What are your legacy and survivor goals? Is the primary goal to maximize income for a surviving spouse? If so, the higher earner delaying their claim becomes a powerful act of stewardship and a cornerstone of your estate plan.

From Questions to a Cohesive Strategy

Answering these questions transforms an abstract financial problem into a personal plan.

For example, a family with a strong desire to protect a surviving spouse—and the portfolio assets to bridge the income gap—will naturally lean toward delaying the higher earner's benefit.

A truly effective framework is not just about the numbers. It is about understanding the human element—your peace of mind, your goals for your family, and your confidence in the path ahead.

Conversely, a business owner who requires liquidity after an exit or has significant health concerns might find that an earlier claiming date is more sensible. The right strategy is the one that provides clarity and stability, allowing you to focus on the next chapter of your life.

This thoughtful, structured process ensures your Social Security decision reinforces, rather than complicates, your comprehensive wealth plan.

A Few Common Questions We Hear

The rules surrounding Social Security can feel complex. For the families we work with from Alpharetta to Dahlonega, these decisions are too important to be left to chance. They must fit within a much larger wealth strategy.

Here are a few of the most common questions that arise in our planning discussions.

How Does Working Affect My Social Security Benefits?

This is a frequent question, especially for business owners or those planning a phased retirement.

If you claim benefits before your Full Retirement Age (FRA) and continue to work, your benefits may be temporarily reduced if your income exceeds a certain annual limit. The key word is "temporarily." Those withheld benefits are not lost. The Social Security Administration recalculates your payment at your FRA to give you credit for them.

Once you reach your FRA, the earnings limit disappears completely. You can earn as much as you wish without any reduction in your benefit payment.

Should I Delay Social Security or Draw Down My IRA First?

This is one of the most important strategic decisions you will make. The right answer depends entirely on your tax situation, your comfort with market risk, and your perspective on longevity.

Delaying Social Security provides a guaranteed, inflation-adjusted return of up to 8% per year—a rate of return that is difficult to find elsewhere without taking on significant risk.

Drawing from your IRA first allows that Social Security benefit to grow to its maximum potential. The trade-off is that IRA withdrawals are taxable, which could create a higher tax liability during the “bridge” years before you claim. A fiduciary advisor can model these scenarios to help identify the most tax-efficient path for your circumstances.

This choice is not about maximizing one account; it is about orchestrating your entire retirement income plan. It requires a balance between the guaranteed growth from Social Security and the market growth potential in your portfolio, all managed within a tax-aware framework.

What Happens to Our Strategy If My Spouse Passes Away?

This is a critical part of planning that is often overlooked. When a spouse passes away, the survivor is entitled to receive the higher of their own benefit or their late spouse's benefit.

This is precisely why maximizing the higher earner's benefit—usually by delaying—is such a powerful strategy. It essentially creates a larger, lifelong, inflation-adjusted income for the surviving partner at a time when they will need it most.

Coordinated spousal planning is not just about numbers. It is about building financial stability to protect your family’s future.

At Jamison Wealth Management, our role is to bring clarity to these critical decisions, ensuring your Social Security strategy is fully integrated with your family’s long-term financial objectives.

To discuss how these strategies apply to your unique situation, we invite you to begin a thoughtful planning discussion.

For high-net-worth families, Social Security is not simply a monthly check; it is a strategic asset class within a comprehensive financial plan that spans decades. The decisions you make about when and how to claim your benefits can create lasting impacts on your portfolio's longevity, your tax efficiency, and the financial security of your spouse.…