Copyright ©

2026 Jamison Private Wealth Management. All Rights Reserved. Privacy Policy Website by ChatmossWeb

tax harvesting cpa and cfp planning

Tax Loss Harvesting Strategies for Family Wealth Management

Posted January 13, 2026

A Disciplined Approach to Tax-Efficient Investing

This is not an attempt to avoid volatility. It is a deliberate tactic for improving your financial outcome. For the families and business owners we work with in communities like Alpharetta, Johns Creek, and across Fulton County, it represents a critical component of a comprehensive wealth management plan.

The principle is straightforward. What truly matters is not just your gross investment return, but your after-tax return. Thoughtfully managing the tax impact of your portfolio is designed to help you keep more of your wealth over the long term.

Why Tax Efficiency Matters in Wealth Management

A comprehensive wealth plan seeks every opportunity to preserve and grow your assets. Tax-loss harvesting aligns with this philosophy by turning inevitable market dips into potential tax benefits. This is especially important for clients with:

- Significant capital gains: When you sell a business, real estate, or other appreciated assets, harvested losses can help soften the resulting tax bill.

- Concentrated stock positions: Executives and long-term investors often use this strategy to offset gains when diversifying a large, single-stock holding.

- Ongoing portfolio rebalancing: As we adjust your portfolio to maintain its target allocation, we can do so in the most tax-aware way possible.

One of the clearest benefits of strategic tax-loss harvesting is its ability to lower your tax liability. A thoughtful approach can provide more detail on how to reduce capital gains tax as part of a bigger financial picture.

For the families we serve in Roswell and Marietta, this is not about chasing short-term market moves. It is about diligent, steady stewardship that connects your investment strategy with your tax reality. This calm, composed method ensures that even in volatile times, your financial plan continues to support your long-term goals.

The Mechanics of a Disciplined Harvesting Approach

At its core, tax-loss harvesting is a disciplined process governed by a clear set of IRS rules, not a complicated trading scheme.

Think of it as financial housekeeping. You are strategically selling an investment that has lost value to create a capital loss. That loss then becomes a valuable tool you can use to reduce your tax bill. Understanding how this works is the key to applying the technique with confidence.

How Losses Offset Gains

The process for offsetting gains follows a specific order set by the IRS. Gains and losses are sorted into two categories: short-term (for assets held one year or less) and long-term (for assets held longer than one year).

The matching process is methodical:

- Short-term losses are first applied against short-term gains.

- Long-term losses are first applied against long-term gains.

If you have leftover losses in one category, you can then use them to offset gains in the other. For example, if your short-term losses exceed your short-term gains, that excess loss can be used against your long-term gains. This is a crucial detail because short-term gains are typically taxed at higher ordinary income rates, so offsetting them first delivers the most immediate tax benefit.

The $3,000 Ordinary Income Deduction

What if your losses are greater than all of your capital gains for the year? The tax code offers another benefit.

You can use up to $3,000 of your remaining net capital loss to lower your ordinary income. For high-earning families in areas like Cumming and Dahlonega, this is a direct and immediate reduction of taxable income from salary, business profits, or other sources.

Any losses above the $3,000 limit are not lost. They become loss carryforwards, which can be carried into future tax years indefinitely. This allows you to “bank” losses from a down year and use them to offset gains from a future event, such as selling a business, a piece of real estate, or simply rebalancing your portfolio.

A disciplined approach to systematically realizing losses can meaningfully enhance after-tax returns. Historical research has shown a potential tax alpha of 1.10% per year from 1926 to 2018, though this benefit is often moderated by specific regulations. You can explore the full study on after-tax returns to understand the long-term impact.

Navigating the Wash-Sale Rule

The single most important regulation in tax-loss harvesting is the wash-sale rule.

This IRS rule is designed to prevent investors from claiming a tax loss without truly changing their investment position. It prohibits you from selling a security at a loss and then immediately buying back the same—or a "substantially identical"—security within a 61-day window (30 days before the sale, the day of the sale, and 30 days after).

You cannot, for instance, sell 100 shares of Company XYZ for a loss on Monday and repurchase them on Tuesday simply to claim the tax deduction. If you violate this rule, the IRS disallows the loss for that tax year.

For high-net-worth families, this rule becomes complicated quickly because it applies across all of your accounts, including those of your spouse. Selling a stock in your taxable brokerage account and repurchasing it in your IRA within 30 days will trigger a wash sale.

This is precisely why a coordinated, fiduciary-led approach is so valuable. An advisor with a complete view of your family’s entire financial picture—including those of households in Kennesaw and Canton—can navigate these complexities, ensuring that a sound tax move in one account does not create an accidental problem in another.

Applying Advanced Harvesting Strategies to Your Portfolio

Knowing the rules of tax-loss harvesting is one thing. Applying it with precision is what separates a basic tactic from a powerful wealth preservation strategy.

For the families we advise, this goes far beyond a quick check-in at year-end. A proactive approach means we are monitoring the portfolio throughout the year, prepared to act on market volatility—not just when the calendar dictates.

This continuous discipline opens the door to more sophisticated techniques. It is about more than just selling an underperforming asset; it is about carefully selecting the right replacement, pinpointing specific tax lots, and timing every action to align with your broader financial picture.

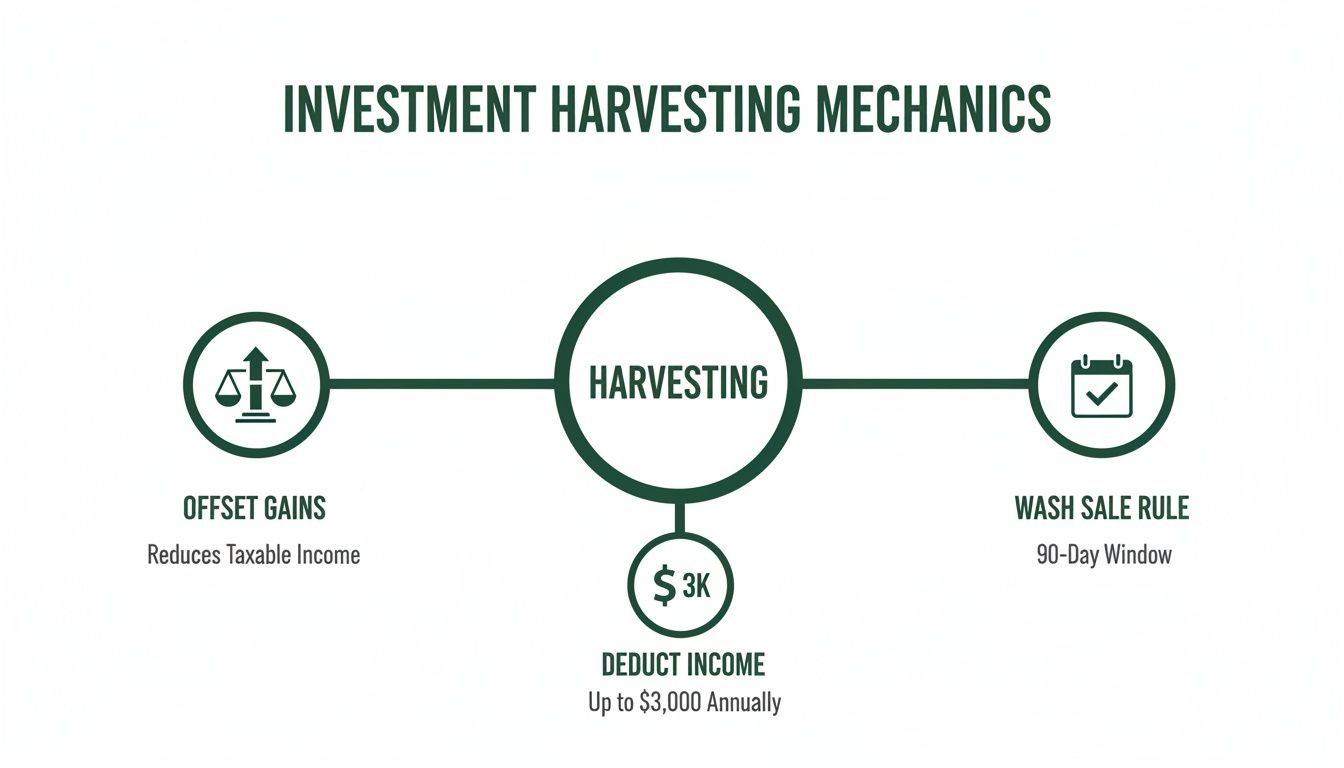

This diagram provides a simple overview of the process.

As you can see, harvested losses first cancel out capital gains. Then, up to $3,000 can be used to reduce your regular income. All of this must be done while carefully navigating the wash-sale rule.

Selecting Appropriate Replacement Securities

When we sell a security to realize a loss, the IRS wash-sale rule states we cannot buy back something "substantially identical" for 30 days. This is a critical rule, but it does not mean you must sit on the sidelines in cash.

The goal is to maintain your portfolio’s intended exposure. We immediately reinvest the proceeds into a suitable, but not identical, replacement.

For example, if we sell an S&P 500 index fund, we might acquire a different fund that also holds large U.S. stocks but tracks a different index, like the Russell 1000. Your capital remains invested and aligned with your strategy, but we have successfully captured the tax loss.

The Nuance of Tax-Lot Harvesting

Most investors own the same stock or fund purchased at different times and for different prices. This is where tax-lot harvesting comes in. Instead of selling the entire position, we can identify and sell only the specific lots with the highest cost basis.

This maximizes the loss we can claim while leaving the lower-cost shares untouched.

Consider a business owner in Alpharetta who has been acquiring the same technology stock for years. We can sell just the shares purchased at a higher price, generating a meaningful tax loss to offset other gains, all without forcing an exit from a position they wish to hold for the long term. It is a surgical approach for complex portfolios.

Effective tax-loss harvesting is a continuous, year-round discipline, not an activity reserved for the last few weeks of the year. Seizing opportunities created by market fluctuations requires consistent monitoring and a proactive mindset.

Year-Round Monitoring Captures Volatility

Market dips do not wait for December. Opportunities to harvest valuable losses can appear—and disappear—in any month. A systematic, year-round process ensures we do not miss them.

Historical data supports this approach. During volatile periods, proactive managers have often harvested significant losses for clients, creating substantial potential tax savings. This demonstrates that even when markets end the year with gains, daily monitoring can identify temporary drops that provide ideal harvesting opportunities.

Comparing Tax Loss Harvesting Approaches

The difference between a casual year-end review and a structured, ongoing strategy is significant. Here is a brief comparison.

| Attribute | Year-End Harvesting | Proactive, Advisor-Led Strategy |

|---|---|---|

| Timing | Reactive; limited to a few weeks in Nov/Dec. | Proactive; monitors and acts year-round. |

| Opportunity | Misses most intra-year volatility. | Captures temporary market dips as they happen. |

| Scope | Often a simple sale/repurchase of broad index funds. | Surgical, using specific tax lots and nuanced replacement securities. |

| Integration | Standalone tax tactic. | Coordinated with major financial events like business sales or stock option exercises. |

| Outcome | Modest, inconsistent tax savings. | Designed to maximize lifetime tax alpha; builds a "bank" of losses for future use. |

A proactive strategy is designed not just to save on this year's taxes, but to systematically improve your after-tax returns over the long haul.

Coordinating with Major Financial Events

For the families we serve across North Georgia, from Dawsonville to East Cobb, tax-loss harvesting is never performed in isolation. It is a tool we integrate into their broader financial life.

We look for opportunities to coordinate harvesting with other key events:

- Exercising Stock Options: When an executive exercises options, it can create a large income tax liability. While capital losses cannot offset that income directly, they can eliminate gains from selling other investments, freeing up cash to pay the tax.

- Selling a Business: The sale of a company often triggers a substantial capital gain. Having a large bank of "carried-forward" losses—built up over years of diligent harvesting—can dramatically soften that tax impact.

- Charitable Giving: We can pair harvesting a loss with donating a different, highly appreciated stock to charity or a Donor-Advised Fund. This creates two separate tax benefits at once: a deduction for the loss and a fair-market-value deduction for the gift.

You can see how these pieces fit into a larger plan by exploring other high-net-worth tax strategies.

Ultimately, these advanced tax-loss harvesting strategies elevate a simple tactic into a core component of long-term wealth stewardship. For those who wish to better understand the numbers behind these strategies, learning how to build financial models in Excel can offer a deeper appreciation for the financial dynamics at play.

Integrating Harvesting into a Comprehensive Financial Plan

Tax-loss harvesting is not something you do in a vacuum. It is not just a year-end chore to check off a list.

For the high-net-worth families we serve, its real power is realized when it is woven into a complete financial plan—one that is fully connected to your broader goals for your wealth, family, and legacy. When viewed this way, a simple tax move becomes a strategic tool that advances your long-term vision.

Connecting Portfolio Management with Tax Strategy

A disciplined harvesting program goes hand-in-hand with sound portfolio management. As we rebalance your portfolio back to its target allocation, we can do so in the most tax-aware way possible.

Imagine an asset class has performed well and now represents an outsized portion of your portfolio. We need to sell some of it. At the same time, we can use losses harvested from other positions to cancel out the gains from that sale. This allows us to bring your risk profile back in line without paying unnecessary tax on your returns.

Effective wealth management ensures that your investment decisions and tax planning are not separate activities, but two sides of the same coin. Each action should support the other, working in concert to enhance your after-tax returns and preserve your capital over decades.

A Strategic Tool for Concentrated Positions

For business owners and corporate executives in communities like Alpharetta and Roswell, a large, concentrated stock position is a common challenge. It is both a source of significant wealth and a substantial risk.

Tax-loss harvesting gives us a powerful way to manage that concentration over time. As you carefully sell shares to diversify, the losses we have banked from other parts of your portfolio can offset the capital gains. This creates a much smoother, more tax-efficient path from a single-stock risk to a properly diversified portfolio.

Fueling Charitable and Legacy Goals

Perhaps the most meaningful application of this strategy is how it supports your family’s philanthropic and estate planning goals. The losses you harvest can create new flexibility, helping you achieve your legacy objectives far more efficiently.

Consider a couple of scenarios we frequently see with families in Fulton and Forsyth County:

- Funding a Donor-Advised Fund (DAF): Suppose you want to make a major gift to charity. We can harvest a loss from one holding and, at the same time, donate a different, highly appreciated stock to your DAF. This move creates two powerful tax benefits: the loss offsets other gains, and you receive a tax deduction for the full market value of the donated stock—without ever paying capital gains on its growth.

- Gifting to Family: If you plan to help a grandchild with college or gift assets to your children, you might need to sell investments for cash. By pairing the sale of a profitable stock with the harvest of an unprofitable one, you can access the cash you need while neutralizing the tax bill from the sale.

This level of coordination is central to our philosophy. It transforms a technical tax strategy into something that directly supports your most important family goals. An integrated approach is especially critical when navigating the complexities of estate planning for high-net-worth families, where every decision can have multi-generational impact.

By connecting your investment management, tax planning, and legacy intentions, we ensure all parts of your wealth are working together to build the future you envision.

The Limitations and When to Be Cautious

As fiduciaries, our role is to present the complete picture. Tax-loss harvesting is a powerful tool in a long-term wealth strategy, but it is important to understand its limitations.

First and foremost, this is a tax deferral strategy, not a tax elimination strategy.

When we sell a position to capture a loss and immediately reinvest in a similar—but not identical—security, the new position has a lower cost basis. This means that when you eventually sell the new investment, your taxable gain will be larger. The primary benefit is delaying that tax bill, keeping your capital invested and working for you for as long as possible.

Don't Let the Tax Tail Wag the Dog

One of the most significant risks is letting the pursuit of tax savings dictate investment strategy. This is a classic case of the "tax tail wagging the dog."

An undisciplined chase for losses can cause a portfolio to drift away from its carefully constructed asset allocation. You can inadvertently alter your risk exposure, a misstep that could be far more costly than any tax benefit you might gain.

This is why our approach is disciplined and integrated. We only harvest losses when it makes sense within your long-term investment plan, ensuring your portfolio remains aligned with your family’s goals. The objective is tax efficiency, not market timing.

Is Tax-Loss Harvesting Always the Right Move?

No, it is not. The effectiveness of this strategy depends entirely on your specific financial situation. It provides the most value for investors who are consistently realizing capital gains, whether from portfolio rebalancing, selling a business, or diversifying a concentrated stock position.

For many investors, the opportunities are limited. In fact, research from tax year 2020 showed that over 90% of individual filers had no net capital gains to offset. This highlights the difference between a standard retail approach and the needs of the high-net-worth families we serve in areas like Alpharetta and East Cobb. Our clients are far more likely to have the kind of substantial gains that make tax-loss harvesting strategies so valuable. For a deeper look at the numbers, you can review this analysis on the economics behind tax-loss harvesting.

A thoughtful wealth strategy acknowledges that not every tool is right for every situation. Our role is to provide objective, personalized advice, determining if and when a tactic like tax-loss harvesting serves your family’s unique financial picture, rather than applying a one-size-fits-all solution.

Ultimately, the decision to harvest a loss must be made within the context of your entire financial life. It requires a clear-eyed view of your current tax situation, your expected future income, and your long-term legacy goals.

Partnering with a Fiduciary for Tax-Smart Investing

Effective tax-loss harvesting is not an automated task to be run in December.

It is a disciplined, year-round strategy that demands a real understanding of tax law, investment management, and—most importantly—your family’s specific financial picture.

It is about seeing how a single move connects to everything else. A harvested loss could be the key to funding a charitable gift, rebalancing a portfolio after a market swing, or untangling a concentrated stock position for an executive in Alpharetta.

This is where a true fiduciary partnership distinguishes itself from an impersonal, algorithm-driven approach.

Confidence Through Integrated Guidance

The real value is not just in the tactic itself. It is in the quiet confidence that comes from knowing your investment and tax strategies are working in lockstep with your estate and legacy goals.

That alignment provides clarity and peace of mind. It ensures every decision is made with your family’s complete story in mind. To see what this standard of care looks like in practice, we invite you to read about what a fiduciary wealth advisor actually does and why it matters.

A successful wealth strategy is built on a foundation of trust and a shared long-term vision. It is the result of a relationship where your advisor understands not just your portfolio, but your family's aspirations and values.

At Jamison Wealth Management, our commitment is to provide this level of stewardship to the families we serve across North Georgia, from Marietta to Dawsonville.

If our thoughtful, integrated approach resonates with you, we would welcome the opportunity to begin a confidential conversation.

Common Questions About Tax-Loss Harvesting

As families in Alpharetta, Roswell, and across North Georgia build their wealth, they begin to ask more sophisticated questions. Tax-loss harvesting is a frequent topic.

Below are a few of the most common questions we hear, with the straightforward answers you should always expect from a fiduciary partner.

Can I Use Tax-Loss Harvesting In My IRA Or 401(k)?

No. This strategy is designed exclusively for taxable investment accounts, such as a brokerage or trust account.

Retirement accounts like IRAs and 401(k)s already grow tax-deferred or tax-free. Gains and losses inside them do not trigger immediate tax consequences, so selling an investment at a loss offers no tax benefit. We focus on applying this strategy where it is effective—in your taxable portfolio—to improve your real, after-tax returns.

How Does The Wash-Sale Rule Work Across Multiple Accounts?

The IRS wash-sale rule is comprehensive. It considers all accounts you and your spouse own or control, including your IRAs.

For example, if you sell a stock for a loss in your taxable account and repurchase it within 30 days in your IRA, the IRS disallows the loss. This is one of the key reasons professional oversight is so critical. A true fiduciary advisor manages your entire portfolio with a holistic view, ensuring a move in one account does not accidentally negate a tax-saving action in another.

A coordinated approach is essential. The wash-sale rule requires a complete understanding of a family’s entire financial situation, reinforcing the value of a single, trusted advisor who can see all the moving parts.

Is Harvesting Worthwhile If I Have No Large Gains This Year?

Yes, it can still be incredibly valuable. This is where long-term strategy comes into play.

If your harvested losses are greater than your capital gains, you can use up to $3,000 to offset your ordinary income, which is often taxed at a higher rate.

Any losses left over can be carried forward indefinitely. Think of it as "banking" tax assets for the future. For business owners or executives who anticipate a significant liquidity event—like selling a company or having a large block of stock vest—this is an exceptionally powerful planning tool. You are building a reservoir of losses to deploy when you need them most.