Copyright ©

2026 Jamison Private Wealth Management. All Rights Reserved. Privacy Policy Website by ChatmossWeb

tax strategy planning

Tax Strategies for Business Owners: A Framework for Long-Term Wealth

Posted January 13, 2026

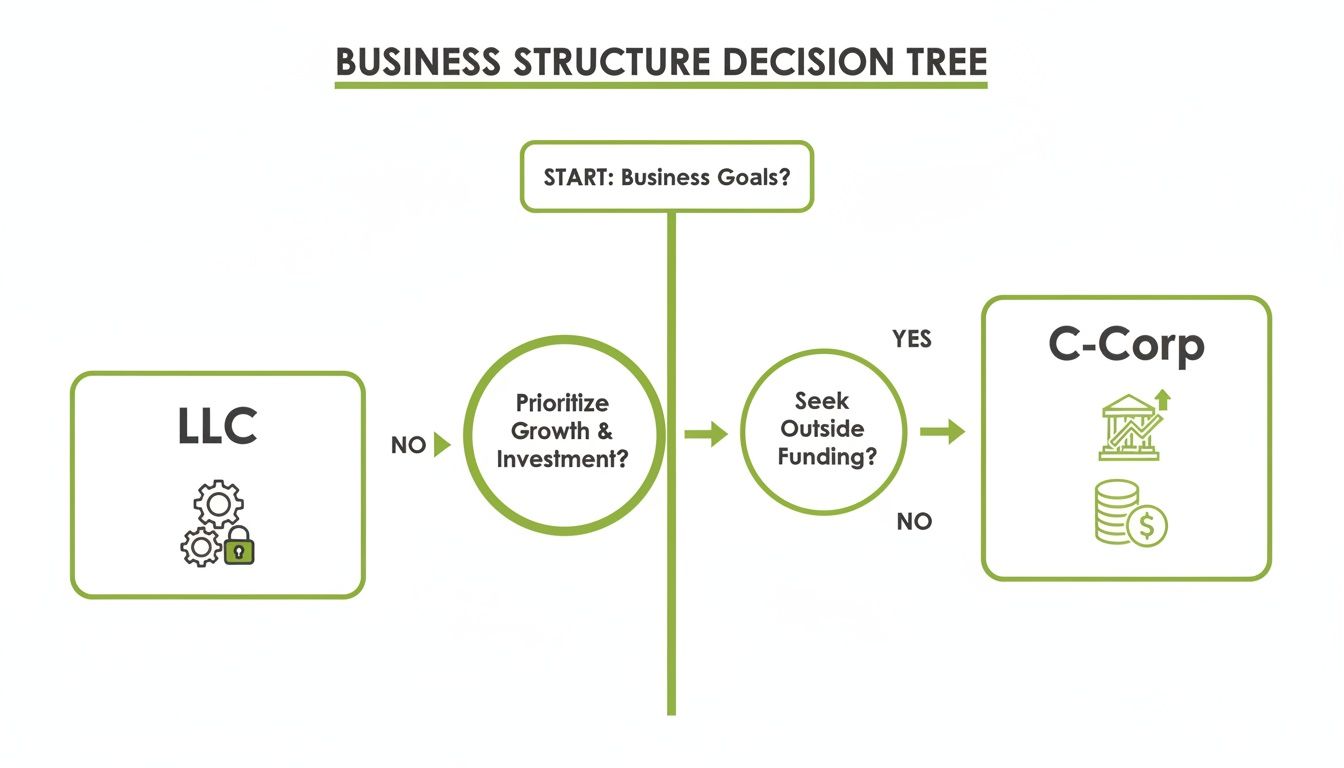

This means your choice of entity—whether an LLC, S-Corp, or C-Corp—is more than a legal filing. It is the foundational decision that dictates how you are compensated, how much you can contribute to retirement, and how you will one day transition the business.

Aligning Your Business Structure With Your Wealth Goals

For any business owner, selecting a legal structure is one of the most consequential financial decisions you will make. It extends far beyond your annual tax return, directly shaping how you build, protect, and eventually pass on your wealth.

Your choice should be a direct reflection of what you want the business to accomplish for your family.

Are you focused on maximizing current income? Reinvesting capital for aggressive growth? Or maintaining flexibility for future partners and investors? The right answer points to a specific structure. Your entity choice is the engine for your financial plan—it creates the pathways for tax-efficient income and powerful retirement savings.

The Strategic Role of Entity Selection

Many business owners, especially here in communities like Alpharetta and Forsyth County, start with one structure only to find their needs evolve. A growing company may need to restructure to limit liability, attract investors, or prepare for a sale.

The key is to view your business structure not as a static decision, but as a dynamic tool. It should be reviewed anytime your personal or professional life evolves.

For example, an S Corporation often makes sense for established, profitable businesses. It allows you to take profits as distributions, which are not subject to self-employment tax. A C Corporation, on the other hand, may be a better fit if you plan to reinvest heavily and need to attract venture capital, as it allows for different classes of stock.

This decision tree helps visualize how your goals point you toward one structure or another.

The image reinforces a central theme: your long-term vision—whether focused on income, growth, or flexibility—should drive your foundational choices from day one.

To help clarify the trade-offs, this table breaks down the strategic differences between the most common business structures. It goes beyond simple tax mechanics to show how each choice impacts your personal compensation, liability, and exit strategy.

Strategic Comparison Of Key Business Entities

| Consideration | S Corporation | C Corporation | LLC/Partnership (Pass-Through) |

|---|---|---|---|

| Compensation Strategy | Owner must take a "reasonable salary" plus can take profit distributions, which are not subject to self-employment tax. | Owners who are employees are paid a salary. Profits are retained in the corporation or paid out as dividends, which are taxed twice. | Owners are not employees and take distributions (guaranteed payments). All net income is subject to self-employment tax. |

| Liability Protection | Provides a strong liability shield, separating personal assets from business debts. | Offers the highest level of liability protection for owners (shareholders). | Provides a liability shield, but it can be less rigid than a corporation's, depending on the operating agreement. |

| Tax Simplicity & Filing | Pass-through taxation (no corporate-level tax), but has strict ownership rules (e.g., number and type of shareholders). | Taxed at the corporate level. Dividends are taxed again at the shareholder level ("double taxation"). More complex filing. | The most flexible option. Can be taxed as a sole proprietorship, partnership, S-Corp, or C-Corp. Pass-through taxation is standard. |

| Succession & Estate Planning | Transfer of ownership is straightforward but restricted to eligible shareholders. Can complicate estate planning due to these rules. | Easiest to transfer ownership through the sale of stock. Ideal for attracting investors and creating different classes of shares. | Ownership transfer is governed by the operating agreement, which can be complex. Less attractive for outside investors. |

This comparison highlights that there is no single "best" entity. The right choice depends entirely on your specific goals for income, growth, and your eventual exit from the business.

Global Trends and Local Implications

This decision is also happening against a backdrop of major economic shifts. Since the 1980s, corporate tax rates have fallen dramatically worldwide. The global average statutory corporate income tax rate dropped from around 46% in 1980 to about 23% in 2024.

This trend creates a complex environment for business owners. As you can explore in more detail on the OECD's corporate tax hub, the effective tax rate for a well-structured business can be significantly lower than the headline numbers suggest. It all depends on your entity choice and how profits are reinvested.

Ultimately, the goal is to build a structure that serves both the business's daily needs and your family's multi-generational wealth plan, ensuring the two are always working in concert.

Optimizing Compensation And Retirement Contributions

For a business owner, your income is not just a number on a profit and loss statement. It is a tool for building lasting wealth.

One of the most powerful tax strategies involves how you pay yourself. Striking the right balance between a reasonable salary and shareholder distributions can significantly lower your overall tax burden.

This is especially true for owners of S Corporations. The salary you take is subject to payroll taxes—Social Security and Medicare. Distributions are not. While the IRS requires you to pay yourself a "reasonable salary" for the work you do, any profit beyond that can be distributed far more tax-efficiently.

This is not about tax avoidance. It is about smart, defensible structuring that keeps more of your hard-earned capital working for you and your family.

This strategic approach to compensation does more than just manage your annual tax liability. It unlocks the door to some of the most powerful retirement savings vehicles available.

Connecting Compensation To Long-Term Retirement Goals

The salary you report as earned income directly dictates how much you can contribute to tax-advantaged retirement plans. By optimizing your compensation, you can maximize your contributions and accelerate your path toward financial independence.

Think of your salary as the key that starts the engine of your retirement savings.

This is where proactive planning turns a compliance task into a wealth-creation opportunity. For many of the business owners we work with in communities from Marietta to Dahlonega, this shift in mindset changes everything.

A well-designed retirement plan is not just an employee benefit—it is one of the most effective tools a business owner has to convert business profits into personal, tax-deferred wealth.

Here are a few of the primary vehicles that become more powerful with a thoughtful compensation plan:

- Solo 401(k): Ideal for owner-only businesses or those that include a spouse. This plan lets you contribute as both the "employee" and the "employer," often allowing for contributions that far exceed a traditional 401(k).

- SEP IRA (Simplified Employee Pension): This plan allows for significant, tax-deductible contributions for yourself and any eligible employees. It is known for its flexibility and high contribution limits, which are based on a percentage of compensation.

- Defined Benefit Plan: For highly profitable, established businesses, this is the most powerful vehicle for tax-deductible contributions. It functions like a traditional pension, where an actuary determines the annual funding needed to reach a specific retirement income goal.

Each of these serves a different purpose. The right choice depends on your company's profitability, your age, and your long-term goals. The core principle, however, is always the same: your compensation strategy and your retirement strategy must be designed together.

You can learn more about how we approach this integrated process by reviewing our guide on retirement planning for business owners.

Building a Plan For Your Future

Choosing and funding a retirement plan is a major decision. A Solo 401(k) offers high contribution limits and a potential Roth component for future tax-free growth. A SEP IRA offers administrative simplicity. A defined benefit plan provides the most aggressive path for tax-deferred savings, especially for owners nearing retirement.

The right approach demands a careful look at your business cash flow, personal financial goals, and timeline. By working with an advisory team that understands the interplay between running a business and building personal wealth, you can create a structure that protects your capital and builds a secure future.

Building A Proactive And Integrated Tax Plan

Most business owners treat tax planning as a reactive, annual event.

Exceptional financial stewardship, however, sees tax planning as a forward-looking, integral part of every business operation. The most impactful tax strategies for business owners are not discovered in April; they are woven into the fabric of decisions made throughout the year.

This mindset moves you from a defensive posture of compliance to a proactive one of opportunity. It is about modeling the tax impact of a decision before it is made, turning tax strategy into a core driver of business value and family wealth.

Shifting From Reactive To Strategic Planning

A proactive approach requires a dedicated team—a fiduciary advisor, a CPA, and legal counsel—all working in concert. Instead of merely gathering documents for a tax return, this team collaborates to map out the consequences of major business moves.

What are the tax implications of buying a new commercial property in Fulton County?

How will a major equipment upgrade affect our depreciation schedule and cash flow for the next five years?

What is the most tax-efficient way to structure an expansion into a neighboring market like Canton or Kennesaw?

Answering these questions in advance lets you structure transactions to serve your long-term goals, rather than discovering a costly mistake after the fact.

The Power Of Scenario Planning

This forward-looking process is built on scenario planning. It involves creating a financial model that shows exactly how different choices affect both the business's bottom line and your personal balance sheet. This provides the clarity to make sound, defensible decisions.

An integrated tax plan anticipates the future. It ensures that your business decisions are always aligned with your goals for personal wealth, family security, and legacy.

This shift reflects a major trend in how successful businesses operate. As you can see in the latest insights on global tax policy trends from Deloitte, tax departments are no longer just filing returns. They are expected to deliver data-driven insights and support major deals.

For new ideas, it can be helpful to explore a variety of frameworks, like these top tax planning strategies for Canadian business owners. While the laws differ, the core principles of proactive planning are universal.

Creating A Cohesive Financial Picture

Ultimately, the goal is to erase the line between your business finances and your personal wealth strategy.

Every choice—from compensation and retirement contributions to succession planning and charitable giving—has a tax consequence. A proactive, integrated plan ensures all these moving parts work together in harmony.

For the families we serve across North Georgia, from Roswell to Dawsonville, this approach creates a powerful sense of control. It transforms tax planning from a source of anxiety into a strategic tool for building and preserving multi-generational wealth. It ensures every business success translates directly into lasting family security.

Once your entity structure and compensation are aligned, it is time to focus on deductions and credits to minimize your tax liability.

A smart tax plan is not just about finding write-offs at the end of the year. It is about strategically timing your investments and expenses to work with your business's natural rhythm. This is how successful owners not only lower their tax bill but also fuel their company's growth.

For many of the businesses we work with, from East Cobb to Cumming, significant capital investments are a yearly reality. Federal tax rules like Section 179 and bonus depreciation are essential tools.

These provisions can dramatically lower the real cost of new equipment or software. Instead of slowly depreciating a large purchase over several years, these rules often allow you to deduct the entire cost in the year of purchase.

That immediate deduction creates a significant cash-flow advantage, freeing up capital that can be put to better use elsewhere in the business.

Beyond Equipment Investment Opportunities

The opportunities do not stop with physical assets.

For companies that innovate, the Research and Development (R&D) Tax Credit is one of the most valuable—and most overlooked—incentives available. It is designed to reward businesses for creating new products, improving processes, or developing software.

Many owners assume the R&D credit is only for tech startups. This is a myth. It can apply to a wide range of activities in manufacturing, engineering, and even certain types of agriculture common across North Georgia.

For S Corps, partnerships, and sole proprietorships, the Qualified Business Income (QBI) deduction is also essential. This allows eligible owners to deduct up to 20% of their qualified business income, but understanding its nuances is critical to receiving the full benefit.

Strategic Timing Of Income And Expenses

One of the most powerful tax strategies is one you have complete control over: timing.

By intentionally moving income and expenses between calendar years, you can manage which tax bracket your profit falls into. This approach is simple but incredibly effective.

For instance, if you anticipate being in a higher tax bracket next year, you can accelerate some of next year's expenses into this year. Conversely, if you had an exceptionally profitable year, you might defer some income into the next.

A proactive tax plan treats the calendar as a strategic asset. It’s about making deliberate choices at year-end that position your business and your family for the most favorable long-term financial outcome.

This all hinges on meticulous records and a clear view of your business pipeline. To effectively use these strategies, knowing how to organize receipts for taxes is non-negotiable. Good documentation is the foundation of any defensible tax plan.

These tools—deductions, credits, and timing—are not meant to be used in a vacuum. Their real power is unlocked when they are woven into your complete financial plan, ensuring every move you make to lower your taxes also supports your larger goals for building and protecting your wealth.

For many successful families, a business is not just an asset on a balance sheet. It is the central pillar of their financial legacy.

The transition of that asset—whether to the next generation, a management team, or an outside buyer—demands careful, integrated planning. It must bridge your business strategy with your personal estate goals.

Viewing succession as a separate, end-of-life task is a common but costly mistake. It should be treated as a proactive strategy designed to preserve value, ensure continuity, and protect what you have spent a lifetime building.

The core challenge is to ensure your business succession plan and your personal estate plan speak the same language. They must work together to minimize taxes and fulfill your wishes for both your family and your company.

Aligning Your Exit With Your Legacy

A successful transition means answering fundamental questions long before you are ready to step away. Do you envision your children taking over? Is a sale to a third party more realistic? Or could a management buyout be the best outcome for your employees and your family?

Each path carries its own tax consequences and requires different legal and financial structures.

The most effective succession plans are not created in isolation. They are the product of a coordinated effort between your wealth advisor, CPA, and estate planning attorney, ensuring every decision supports your complete financial picture.

This team-based approach is essential for navigating the complexities of transferring a business. It makes sure the structure of the sale or transfer is as tax-efficient as possible, protecting the proceeds for your family’s future. For an in-depth look at the foundational elements, our guide to estate planning for high-net-worth families provides critical context.

To help clarify these choices, here is a look at the primary transition pathways and what they mean for your planning.

Key Considerations For Business Transition Pathways

| Transition Path | Primary Tax Consideration | Best For… | Key Planning Step |

|---|---|---|---|

| Family Succession | Minimizing estate & gift taxes through structured transfers (e.g., GRATs, gifting). | Maintaining a family legacy and keeping the business under private control. | Developing a clear leadership transition and training plan for the next generation. |

| Management Buyout (MBO) | Structuring the sale to be tax-efficient for both the owner and the buying employees. | Rewarding key employees and ensuring operational continuity with a known team. | Securing financing for the management team and creating a realistic payment structure. |

| Third-Party Sale | Optimizing the business valuation and minimizing capital gains tax on the proceeds. | Maximizing the financial return and achieving a clean exit from the business. | Engaging M&A advisors early to prepare the business for sale and attract qualified buyers. |

| Liquidation | Managing tax implications of selling off assets individually. | Businesses with valuable tangible assets but limited ongoing operational value. | Creating an orderly wind-down plan to maximize asset value and settle liabilities. |

Each option requires a different playbook. Thinking through them early prevents forced decisions and preserves the value you have created.

Essential Tools for a Smooth Transition

Several key instruments are central to executing a thoughtful succession strategy. These are not just legal documents; they are strategic mechanisms for controlling the future of your business while optimizing the financial outcome.

-

Buy-Sell Agreements: This document acts as a prenuptial agreement for your business. It clearly defines what happens to a partner’s shares upon retirement, death, or disability. A well-drafted agreement prevents disputes and can lock in a valuation method, providing certainty for all parties.

-

Grantor Retained Annuity Trusts (GRATs): A GRAT can be a powerful tool for transferring ownership to the next generation while minimizing taxes. It allows you to freeze the value of the business for estate tax purposes and pass future appreciation to your heirs with little to no gift tax impact.

-

Strategic Gifting and the Lifetime Exemption: The lifetime gift and estate tax exemption allows you to transfer a significant amount of wealth tax-free. By strategically gifting shares of the business over time, you can gradually pass ownership to family members, reducing your taxable estate while staying within IRS guidelines.

This kind of proactive planning is more important than ever. As PwC highlights in its reporting on global tax enforcement, it is now "very likely" that governments will increase business taxes while intensifying enforcement.

A data-driven, aggressive tax environment makes documented, defensible strategies essential. Having an integrated team ensures your succession and estate plans are not just compliant, but strategically sound.

Partnering With A Fiduciary For Comprehensive Guidance

Smart tax strategy is not something you handle once a year. It is an ongoing process that must be woven directly into your investment management, retirement planning, and long-term estate goals.

Attempting to manage it in a silo is ineffective. A dedicated strategic partner, not just a tax preparer, is essential.

This is where a true fiduciary relationship makes all the difference. The goal is to ensure every part of your financial life is working together, creating a single, cohesive strategy for your business and your family.

The Value Of An Integrated Team

A fiduciary wealth advisor acts as the coordinator for your entire financial picture. Their role is to ensure your business decisions support your personal wealth goals instead of conflicting with them.

For business owners here in North Georgia, from Roswell to Johns Creek, this brings a great deal of clarity. You are not juggling different advisors who do not communicate. You have one team that understands your business, your family, and what you are ultimately trying to build.

The greatest value lies in the confidence that comes from knowing every recommendation is made with a clear understanding of your complete financial life and always in your best interest.

This relationship is built on a deep understanding of what a fiduciary wealth advisor actually does, which goes far beyond selecting investments. It is about creating a durable framework designed to build and preserve your wealth for generations.

A Relationship Built for the Long Term

An effective tax strategy is not a one-time fix. It is a continuous conversation.

As your business grows and your family’s needs change, your financial plan must adapt. A long-term partnership ensures you have proactive guidance through every stage of your company’s life.

It is about building a foundation of trust that allows for candid conversations and confident decisions, year after year.

For business owners who are seeking this level of thoughtful guidance, the next step is to start a confidential conversation.

Common Questions About Business Tax Strategy

As business owners transition from simply getting taxes done to getting them done strategically, important questions often arise. Here are a few we hear from families we serve, from Marietta to Dawsonville.

How Often Should I Review My Business Tax Strategy?

We recommend a comprehensive review of your tax strategy at least once a year.

However, the strategy should be revisited any time something significant changes. A major equipment purchase, a shift in ownership, a substantial change in revenue, or new tax legislation are all triggers for a review.

The goal is to keep your tax plan aligned with your life and business as they evolve.

My CPA Handles My Taxes. Why Do I Need A Wealth Advisor Involved?

Your CPA is essential for filing your taxes correctly and maintaining compliance. Their role is critical.

A fiduciary wealth advisor’s role is different. We connect your business tax strategy to your entire financial life: your investment portfolio, retirement timeline, estate plan, and family's long-term security. We ensure a smart tax decision for the business does not create an unintended problem for your personal goals.

We work alongside your CPA, ensuring all components of your financial plan are integrated. This elevates tax planning from an annual event into a core part of your family’s financial foundation.

At What Stage Of Business Should I Start This Level of Planning?

You should start from day one. What changes over time is the complexity.

A business's life cycle naturally dictates its tax planning priorities. The goal is to match the sophistication of your strategy to the current stage of your company.

When you are starting out, the focus might be on choosing the right business entity and ensuring you capture all basic deductions.

Once the business is consistently profitable, the conversation shifts to owner compensation and maximizing retirement plans.

For a mature, highly valuable business, planning naturally turns toward succession, estate, and legacy goals. The key is to have a framework that grows with you.

At Jamison Wealth Management, we believe a thoughtful tax strategy is the bedrock for protecting and growing family wealth. If our integrated approach aligns with your goals, we invite you to begin a thoughtful planning discussion.

Effective tax strategies for business owners are not about finding last-minute deductions. They are about designing the business itself to protect long-term wealth and support your family’s future. This means your choice of entity—whether an LLC, S-Corp, or C-Corp—is more than a legal filing. It is the foundational decision that dictates how you are compensated,…