Copyright ©

2026 Jamison Private Wealth Management. All Rights Reserved. Privacy Policy Website by ChatmossWeb

A Guide to Estate Planning for Families: Securing Your Legacy

Posted January 7, 2026

A Modern Approach to Estate Planning for Families

For many, the term "estate planning" evokes complex legal forms and conversations best avoided. However, a modern approach is not about planning for an end but about taking deliberate control of your legacy. It is an ongoing expression of care that moves beyond distributing assets to create a clear roadmap for your family’s future.

The primary objective is to replace uncertainty with clarity. This shift is particularly vital for multi-generational families and business owners in communities like Alpharetta, Roswell, and Johns Creek, where financial complexities require a sophisticated and integrated strategy.

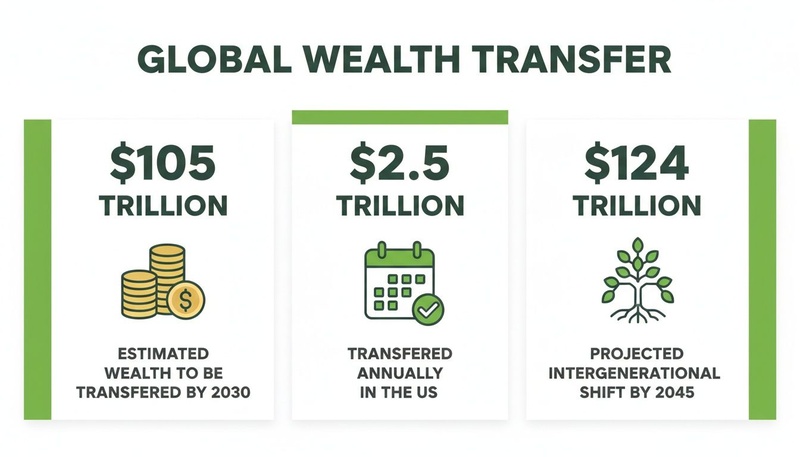

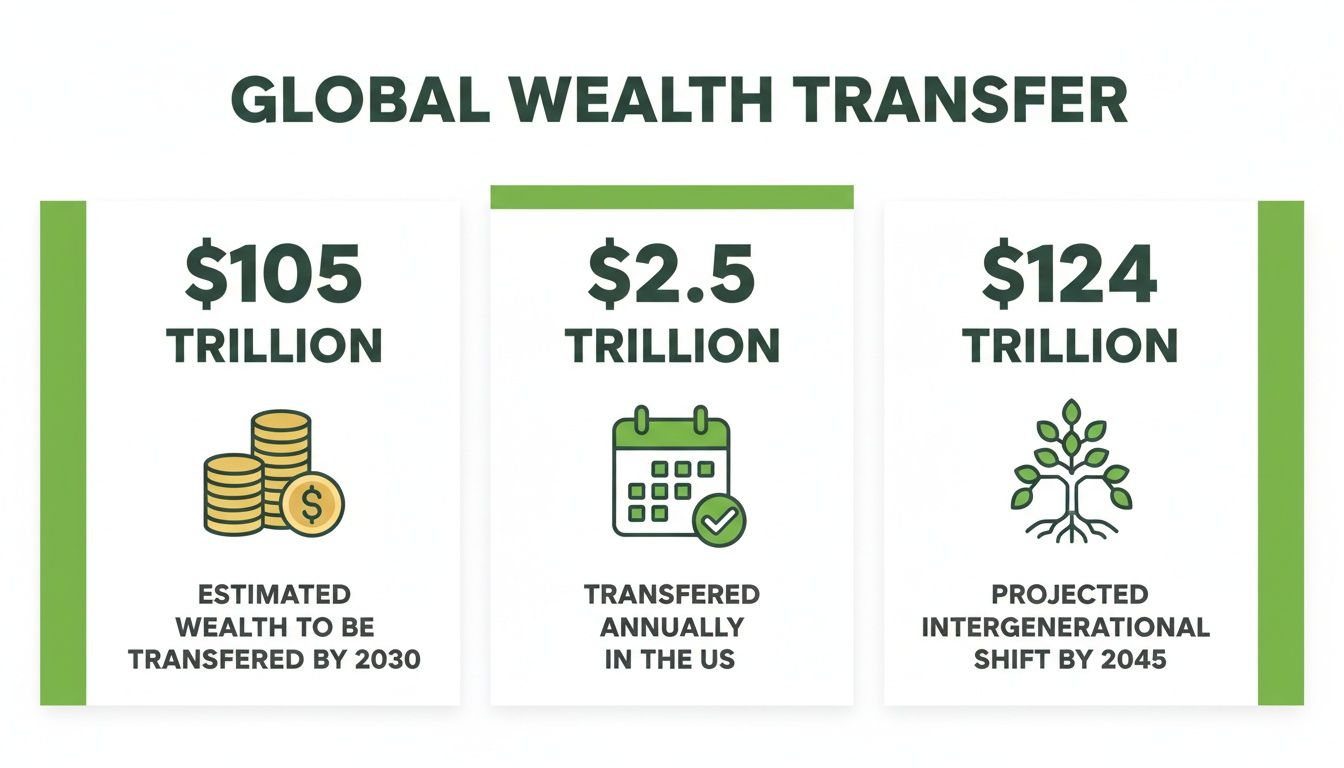

The Great Wealth Transfer

We are in the midst of a historic shift that will reshape family finances for decades. Over the next 25 years, an estimated $105 trillion in assets will pass between generations, with $2.5 trillion changing hands in 2025 alone. This is not merely a statistic; it is a profound event that makes proactive, strategic planning essential.

Without a coordinated approach, families face unnecessary tax burdens, administrative complexities, and the genuine risk of eroding the wealth they have worked diligently to build. The sheer scale of this transfer underscores the importance of professional guidance for anyone serious about protecting their family's legacy.

This infographic helps put these figures into perspective.

These numbers confirm that robust estate planning is a fundamental component of responsible financial stewardship.

More Than Documents—A Strategy for Peace of Mind

Consider your estate plan the foundation of your family's long-term financial health. It is the master strategy that coordinates wills, trusts, and tax considerations into a single, cohesive framework designed to function as intended.

A properly integrated plan delivers several crucial outcomes:

- Clarity for Your Heirs: A clear plan removes ambiguity and the potential for conflict, allowing your family to focus on what matters most during a difficult time.

- Asset Protection: A well-structured plan is designed to shield assets from creditors, legal challenges, and taxes that can quietly diminish an inheritance.

- Privacy and Efficiency: Utilizing tools such as trusts can help your estate avoid the public, lengthy, and often costly probate process.

Ultimately, effective estate planning is about creating the future you envision for your family. It directly addresses the hidden cost of financial uncertainty and how planning reduces it by providing a framework that honors your intentions and secures your family’s well-being.

The Foundational Documents of Your Family Legacy

A thoughtful estate plan is not built on a single document. It is a carefully constructed set of legal tools designed to work in concert, protecting your family and providing clear direction for your assets.

While the legal language can seem complex, the purpose is simple: to provide clarity and maintain control. For the families we advise in communities from Alpharetta to Dahlonega, understanding these core documents is the first step toward building a legacy that endures.

Consider your estate plan a vessel crafted to navigate your family’s future. Each document is a critical component—the hull, the rudder, the sails—ensuring the ship is sound and the precious cargo of your life’s work reaches its intended destination. Understanding the essential estate planning documents is the start of that journey.

The Last Will and Testament: Your Final Instructions

When most people consider estate planning, they think of a Last Will and Testament. This document's primary function is to provide clear instructions for distributing your property after your death.

Just as importantly, a will is where you name a guardian for your minor children. For any young family, this is one of the most profound and necessary decisions you will make.

However, a will is not the complete solution. It only becomes active after death and must pass through a public court process called probate, where a judge validates the will and oversees the distribution of assets. This can be a slow, expensive, and public process. While a will is vital, it is often just one piece of a more private and efficient strategy.

The Revocable Living Trust: The Private Operating Manual

For many high-net-worth families in Forsyth and Fulton counties, a Revocable Living Trust serves as the true cornerstone of their estate plan. It acts as a private "operating manual" for your financial life.

While you are alive, you serve as the trustee and maintain complete control over all assets placed within it. In your day-to-day life, nothing changes.

The distinct power of a trust is its ability to bypass probate entirely. Since the trust—not you—technically owns the assets, there is nothing for the court to administer. This allows for a seamless, private, and much faster transfer of wealth to your heirs, all according to the precise instructions you have established.

A trust provides a structured framework for stewardship that can extend for generations, protecting assets from creditors and ensuring they are managed wisely for beneficiaries who may not yet be ready to handle a significant inheritance.

This level of control and privacy is why trusts are central to effective estate planning for families with significant or complex assets.

Powers of Attorney: Designated Decision-Makers

Life is unpredictable. A sound plan must account for the possibility that you might become unable to make decisions for yourself. This is where Powers of Attorney are critically important. These documents empower people you trust to act on your behalf if you cannot.

There are two key types:

- Durable Power of Attorney for Finances: This document names an "agent" to manage your financial affairs—pay bills, handle investments, manage real estate—if you become incapacitated.

- Power of Attorney for Health Care (Advance Directive): This appoints an agent to make medical decisions for you, guided by your written wishes, ensuring your preferences are respected when you cannot voice them yourself.

Without these documents, your family would likely be forced to petition the court for a conservatorship. This is a public, expensive, and emotionally draining process that could place a stranger in charge of your personal and financial life. These documents keep control within your family and protect your dignity during a difficult time.

Core Estate Planning Documents: A Strategic Overview

To understand how these pieces fit together, it helps to see them side-by-side. Each document has a distinct role, but all are designed to support a single, cohesive strategy for your family.

| Document | Primary Function | Key Benefit for Your Family |

|---|---|---|

| Last Will and Testament | To distribute assets and name guardians for minor children after death. | Provides legally binding final instructions and ensures care for your children. |

| Revocable Living Trust | To hold and manage assets during your lifetime and distribute them after death, avoiding probate. | Ensures privacy, efficiency, and a seamless transfer of wealth outside of court. |

| Powers of Attorney | To appoint agents to make financial and healthcare decisions if you become incapacitated. | Prevents the need for court intervention and protects your family’s control. |

Together, these documents form a protective shield. They are designed to ensure your wishes are honored, your family is protected from unnecessary court proceedings, and your legacy transitions smoothly and privately to the next generation.

Advanced Strategies for Complex Family Estates

For families with significant assets, business interests, or complex dynamics, a basic will and revocable trust are merely the starting point. They are the foundation upon which a more robust structure must be built to preserve wealth, manage tax exposure, and ensure your legacy endures for generations.

This is where planning moves beyond standard documents and into sophisticated strategies designed for more complex financial situations. These are well-established legal and financial tools used to achieve specific, long-term family objectives.

Preserving Wealth with Specialized Trusts

When an estate's value may approach or exceed federal exemption limits, certain specialized trusts become instrumental. They are not replacements for a primary living trust but rather powerful additions built for targeted asset protection and tax management.

Two of the most effective instruments are the Irrevocable Life Insurance Trust (ILIT) and the Grantor Retained Annuity Trust (GRAT).

-

Irrevocable Life Insurance Trust (ILIT): An ILIT is created for a single purpose: to own a life insurance policy. By moving the policy out of your personal estate and into the trust, the death benefit is generally not considered part of your taxable estate. This can provide your heirs with a source of tax-free liquidity to pay estate taxes or other expenses without being forced to sell a family business or property.

-

Grantor Retained Annuity Trust (GRAT): A GRAT is a strategic tool for transferring future asset appreciation to beneficiaries with minimal gift or estate tax impact. You place an asset into the trust and, in return, receive a fixed annual payment for a set term. At the end of that term, any appreciation above a specific IRS interest rate is designed to pass to your heirs, free of gift or estate taxes.

These strategies require precision and careful integration with your overall financial plan. Our guide to estate planning for high-net-worth individuals offers more detail on how these structures can help protect significant family wealth.

Planning for Unique Family Circumstances

Every family is unique, and a thoughtful estate plan must reflect that reality. For many of our clients in communities like Johns Creek, Cumming, and Canton, this means planning for situations that extend far beyond the simple distribution of assets.

Business Succession Planning

For an entrepreneur, the family business is often their life’s work. A succession plan creates a smooth transition of leadership and ownership, helping to prevent ambiguity and family conflict. It addresses critical questions now: Who takes over? How is ownership transferred? And how are family members not involved in the business treated equitably?

A well-designed succession plan is more than a legal document; it is a strategic roadmap that secures the company's future while protecting the family's financial well-being. It provides clarity for employees, stability for customers, and peace of mind for you.

Special Needs Planning

If you have a child or another loved one with a disability, a Special Needs Trust is essential. This type of trust allows you to set aside funds for their care without jeopardizing their eligibility for crucial government benefits like Medicaid or SSI. The assets are managed by a trustee you choose, ensuring your loved one has lifelong support as you intended.

Integrating Charitable Giving

Philanthropy is a powerful way to carry your family's values forward. When structured strategically, it can also offer significant tax advantages. Tools such as Donor-Advised Funds (DAFs) or Charitable Remainder Trusts (CRTs) allow you to support the causes you care about with a structured, tax-efficient approach.

These advanced strategies demonstrate that true estate planning is a dynamic and deeply personal process. It is about building a thoughtful plan that accounts for your entire financial world and secures the future you envision for the people you love.

Why Asset Titling and Beneficiaries Matter

A well-drafted will and trust may feel like the final pieces of the puzzle. However, many families overlook a small detail with the power to unravel their entire estate plan: asset titling and beneficiary designations.

The forms you complete for retirement accounts, life insurance, and bank accounts are legally binding contracts. In a dispute, they almost always override the instructions in your will or trust. This is one of the most common and consequential mistakes in estate planning.

The Power of a Simple Form

Imagine you opened a 401(k) at your first job and named your spouse as the beneficiary. Years later, you have divorced and remarried, and your will now leaves all your assets to your current family.

If you never updated that original 401(k) beneficiary form, the entire account could be distributed to your ex-spouse. Your will's instructions would be irrelevant.

This is not a rare scenario; it affects families across Alpharetta and East Cobb. A simple administrative oversight can misdirect a lifetime of savings, and the outcome is often irreversible.

Beneficiary designations are not suggestions. They are direct instructions that financial institutions must follow. Aligning them with your will and trust is non-negotiable for a plan that functions as intended.

This is why we believe in a comprehensive approach. Every component of your financial life—from property deeds to investment accounts—must be aligned to achieve your objectives for your family.

Aligning Titles and Designations with Your Plan

Ensuring your assets are correctly aligned is a meticulous but essential process. It involves reviewing every account and property deed to confirm that the ownership and beneficiary instructions match your estate plan precisely.

This review covers several key areas:

- Retirement Accounts: Verifying beneficiaries on all IRAs, 401(k)s, and 403(b)s to ensure they reflect your current wishes, not your circumstances from twenty years ago.

- Life Insurance Policies: Confirming that the individuals named on your policies are still the people you intend to protect.

- Bank and Brokerage Accounts: Reviewing "Payable on Death" (POD) or "Transfer on Death" (TOD) designations that might inadvertently contradict your trust.

- Real Estate Deeds: Ensuring your home and other properties are titled correctly—often in the name of your trust—to avoid probate and pass according to your plan.

This is where a coordinated team of advisors makes a significant difference. A fiduciary wealth advisor, working alongside your estate planning attorney, can manage this review. This ensures no detail is overlooked, so every part of your financial life points in the same direction, providing confidence that your plan will work exactly as you designed it.

Assembling Your Professional Advisory Team

Proper estate planning is a collaborative endeavor, not a solitary one. To build a plan that truly stands the test of time, you need a team of seasoned professionals working together. Think of it as assembling a personal board of directors for your family's future.

This team approach ensures every decision—from how your investments are structured to how your legal documents are drafted—is fully aligned. For the families we work with in Roswell, Marietta, and Cumming, this integrated strategy provides the confidence that comes from knowing every piece of their financial life is working in concert.

The Key Players on Your Team

A strong advisory team is built around three core professionals, each with a distinct and vital role.

-

Estate Planning Attorney: The legal architect of your plan. They draft the foundational documents—your will, trust, and powers of attorney—ensuring they are legally sound and accurately reflect your intentions. Their expertise is in the law, compliance, and the specific language required to make your plan effective.

-

Certified Public Accountant (CPA): Your CPA serves as the tax strategist. They provide critical insight into the tax implications of every decision, from how an asset is titled to how a trust is structured. Their objective is to help minimize income, gift, and estate taxes, preserving more of your wealth for your family.

-

Fiduciary Wealth Advisor: The wealth advisor often serves as the "quarterback" for the team. This professional understands your complete financial picture, your family dynamics, and your long-term goals. Their primary role is to coordinate the efforts of your attorney and CPA, ensuring legal and tax strategies fit seamlessly with your investment strategy and overall financial plan.

The Power of a Coordinated Approach

While having these three professionals is a good start, ensuring they work together is what makes a plan truly robust.

When advisors operate in silos, important details can be missed. An investment decision might create an unexpected tax liability. A legal document may not align with how an account is actually titled.

A coordinated team is designed to prevent these costly oversights. Your wealth advisor maintains open lines of communication, ensuring your attorney understands your investment portfolio and your CPA is aware of the trust structures being created. This synergy transforms your plan from a collection of documents into a living, cohesive strategy.

An integrated plan means your wealth manager, attorney, and CPA are all working from the same blueprint: your family's goals. This collaborative approach elevates a good plan to a great one, capable of weathering life’s complexities.

This is the standard of care we believe every family deserves. As fiduciaries, our responsibility is to ensure every aspect of your financial life is managed with precision and foresight. To better understand this central role, you can learn more about what a fiduciary wealth advisor actually does and why it matters. This collaborative model positions your advisor as the central, trusted partner for your family's financial future.

Bringing Your Estate Plan to Life

Signing your foundational estate planning documents is a significant milestone. But the documents themselves are just the starting point.

An estate plan is not a finished product; it is a strategy that must be put into motion. The real work begins here, translating your intentions into action to ensure the plan functions when it is needed most.

This involves titling assets in the name of your trust and verifying every beneficiary designation. Without these critical follow-through steps, even the most thoughtfully designed plan can fail to achieve its purpose.

The Plan as a Living Strategy

Your family’s life is not static, and neither is your estate plan. It is a living strategy that must evolve with you.

A marriage, the birth of a child, the sale of a business, or a change in residence are all life events that can have a material impact on your plan.

Furthermore, external factors like changes to federal or Georgia state tax laws can reshape the financial landscape. Regular reviews are not an inconvenience; they are a fundamental component of ensuring your plan remains resilient and effective for the long term.

An estate plan that remains untouched in a drawer for a decade is a plan likely to fall short of its objectives. Proactive stewardship ensures your intentions are faithfully carried out, regardless of how much time has passed or how circumstances have changed.

Your Implementation and Review Checklist

Putting your plan into action involves a series of concrete steps. For the families we advise from Alpharetta to Dawsonville, a coordinated advisory team helps manage these details, providing clarity and confidence throughout the process.

Key action items include:

- Funding Your Trust: This is the process of retitling assets, such as real estate and non-retirement investment accounts, from your individual name into the name of your trust.

- Verifying Beneficiaries: A detailed review of every beneficiary named on your retirement accounts (IRAs, 401(k)s) and life insurance policies is critical to confirm alignment with your overall plan.

- Coordinating with Your Trustee: If you have named a professional or corporate trustee, they need to understand their role and your intentions. Clarifying practical details, like the trustee responsibilities after death, is essential for a smooth transition.

- Scheduling Regular Reviews: Establish a rhythm for reviewing your plan—typically every three to five years or after any significant life event—to make necessary adjustments.

This ongoing process is the cornerstone of responsible wealth stewardship. It moves your family beyond good intentions to concrete action, ensuring your legacy is genuinely protected.

At Jamison Wealth Management, our role is to be your family’s long-term partner, coordinating these complexities so you can focus on what matters most. If our approach to stewardship aligns with your goals, we welcome you to schedule a confidential conversation.

Common Questions About Estate Planning for Families

Beginning the estate planning process often brings up important questions. This is natural, as the decisions involved are about ensuring the people you love are cared for, no matter what happens.

Having clear answers helps you move forward with confidence. Here are a few of the most common questions we hear from families in our community.

How Often Should We Review Our Estate Plan?

An estate plan is not a "set it and forget it" document. As your life evolves, your plan should too.

We recommend a comprehensive review with your advisory team every three to five years. More importantly, you should revisit the plan following any major life event—a marriage, the birth of a child or grandchild, a significant change in your financial situation, or shifts in estate tax laws. A regular review ensures your plan continues to accurately reflect your intentions.

What Is Probate and Why Is It Best to Avoid?

Probate is the court-supervised process of validating a will and settling an estate. In Georgia, it can be a lengthy, expensive, and public process. It makes your family’s financial affairs a matter of public record, which most people prefer to avoid.

The goal of good planning is to make the transfer of your legacy as simple and private as possible for your family. A well-structured plan utilizing tools like a Revocable Living Trust and correct asset titling can help your estate bypass the probate court entirely, resulting in a faster, more efficient, and far less stressful transition for your heirs.

How Do We Choose the Right Trustee for Our Estate?

This is one of the most critical decisions in the estate planning process. Your trustee is the person or institution you are entrusting to manage your assets and execute your wishes precisely.

Key qualities to look for are unwavering integrity, sound financial judgment, and impartiality. While a trusted family member may seem like the obvious choice, this can place them in a difficult position, especially when balancing the needs of multiple beneficiaries. Many of the families we work with choose a professional or corporate trustee. This approach removes emotion from the decision-making process and brings a level of expertise needed for complex assets or delicate family dynamics.

There is no single right answer. A thoughtful conversation with your wealth advisor is the best way to weigh the options and determine what makes the most sense for your family.

At Jamison Wealth Management, our purpose is to bring clarity and strategic coordination to this process, helping your family build a legacy that lasts. If our approach aligns with your goals, we invite you to begin a thoughtful planning discussion.

Explore whether our firm is the right fit for your family at https://jamisonwealth.com.