Copyright ©

2026 Jamison Private Wealth Management. All Rights Reserved. Privacy Policy Website by ChatmossWeb

business owner concerns over retirement planning

A Fiduciary Guide to Retirement Planning for Business Owners

Posted January 5, 2026

A Fiduciary Guide to Retirement Planning for Business Owners

For most successful entrepreneurs, their business is more than a company. It is their identity, their life’s work, and the primary asset they believe will secure their family’s future. But true financial independence is not measured by what the business is worth on paper. It is achieved through a deliberate plan to separate personal wealth from the company you built.

Retirement planning for a business owner is a distinct discipline. It is the strategic process of converting the value you have created into a liquid, reliable income stream designed to support your family for decades to come.

Your Business Is Not Your Retirement Plan

From Alpharetta to Dahlonega, we see a common perspective among successful entrepreneurs. An owner’s business represents everything they have accomplished—an engine for the local economy and the core of their net worth. It is understandable to view that asset as a retirement nest egg.

But this perspective overlooks a critical distinction: the difference between business value and dependable, personal income.

Your company’s valuation is a theoretical number until a liquidity event—a sale, a buyout, or a transfer—converts it into actual capital. Relying entirely on that future, uncertain event is not a retirement strategy. It is a significant and unnecessary risk.

Shifting the Mindset from Value to Income

A successful retirement is not funded by a balance sheet. It is funded by predictable cash flow—capital that arrives consistently to sustain your lifestyle, cover healthcare costs, and provide for the people you love long after you have handed over the keys.

The objective is to strategically move wealth from a single, illiquid business asset into a diversified portfolio built for long-term stewardship.

This process requires asking direct and necessary questions:

- After taxes, professional fees, and closing costs, how much of the company's sale price will I actually retain?

- How can I structure that lump sum to generate a reliable income stream for the next 20 or 30 years?

- What is our contingency plan if the sale is delayed or the final offer is lower than anticipated?

A business provides an income. A retirement plan provides independence. As fiduciary advisors, our role is to build a bridge between the two, ensuring the success you built translates into the future you have always envisioned.

An Integrated Approach to Secure Your Future

The solution is not to downplay the importance of your business. It is to protect the future that business was always intended to provide.

This requires an integrated, advisor-led approach that connects your business exit plan directly to your personal wealth strategy. It means making coordinated decisions on taxes, investments, and estate objectives years before a sale is contemplated.

This guide provides a clear, structured framework for this transition, designed to replace uncertainty with clarity and a confident path forward.

Why Retirement Planning Is Different for Entrepreneurs

For a traditional employee, the path to retirement often follows a predictable course.

Contributions are made to a 401(k) year after year, building a diversified portfolio designed for steady withdrawals in the future. For an entrepreneur, that journey could not be more different.

Your wealth is not spread across dozens of stocks and bonds. It is concentrated in one deeply personal, illiquid asset—your business. This single fact changes every aspect of retirement planning, shifting the focus from slow, steady accumulation to a single, defining liquidity event.

The Great Divide: Concentration vs. Diversification

Imagine a traditional retirement account as a reservoir filled by dozens of small streams over a 40-year career. The water level rises gradually and reliably.

A business owner’s financial life is fundamentally different. You are waiting for one massive river to arrive. Your family’s future hinges on that single flow of capital from a sale or ownership transfer.

This concentration creates a unique set of pressures:

- Timing is everything. Your retirement date is not just a number on a calendar; it is tied to market cycles, industry trends, and identifying the right buyer at the right time.

- Valuation is paramount. The difference between your company's on-paper net worth and the actual cash you receive after taxes and fees can be substantial.

- The stakes are higher. You have one opportunity to execute this transition correctly. A poorly managed business exit can undermine decades of hard work and place your family’s future at risk.

A "set it and forget it" mindset simply does not apply here. A passive approach is not a viable strategy when your entire legacy is tied to one complex transaction.

Navigating the Emotional Hurdles

Beyond the financial complexities, the emotional dimension of selling a business often complicates the process. Your company is more than an asset; it is your identity, your legacy, and your life’s work.

This deep personal connection makes it difficult for many owners to begin the conversation about letting go.

In fact, it is a key reason why so many plan to retire later. A recent First Citizens survey found the average expected retirement age for business owners is 66, a full year later than their peers. This delay is not always about finances; it is often driven by the desire to achieve professional milestones. However, this extended timeline can mask a critical lack of preparation, as roughly half of all owners admit they have no formal exit strategy. You can discover more insights from the 2025 Business Owner Survey on their website.

Planning for your retirement is not about abandoning your business. It is about honoring your life’s work by ensuring it provides the future you always intended for yourself and your family. This reframes the conversation from loss to stewardship.

For the families we serve in communities from Roswell to Johns Creek, this transition is one of the most significant they will ever face. Recognizing that these challenges are unique—and entirely manageable—is the first step. With a fiduciary partner who understands both the balance sheet and the human element, you can build a thoughtful plan that converts your hard-earned business equity into lasting personal wealth and peace of mind.

The Four Pillars of a Business Owner's Retirement Strategy

A sound retirement strategy for an entrepreneur is not a single decision. It is a structure built on four essential, interconnected pillars.

This framework is designed to convert your life's work into lasting financial security for you and your family. For the business owners we work with in communities like Alpharetta and Cumming, it brings much-needed clarity to what can feel like an overwhelming process.

The strategy addresses a few critical questions: How do you unlock the value of your business? How do you protect it? How do you transform it into a reliable income? And how do you ensure it secures your family’s future?

Pillar 1: Business Valuation and Exit Strategy

This is the cornerstone. You cannot effectively plan for retirement until you know what your single largest asset—your business—is actually worth.

This is not a back-of-the-napkin calculation or an industry rule of thumb. It requires a formal, objective valuation that analyzes cash flow, assets, and market position. Once you have a credible number, the focus shifts to your exit strategy—the roadmap for converting that on-paper value into liquid wealth.

This phase demands specificity:

- Will you sell to an external buyer, transfer ownership to family, or transition to key employees?

- What is your ideal timeline for this transition?

- What steps must you take now to maximize the company's value and make it attractive to a buyer or successor?

Without a clear exit plan, your business's value remains trapped, and your retirement remains a vague concept rather than a concrete reality.

Pillar 2: Tax-Efficient Wealth Management

A successful business exit can trigger the single largest tax event of your life. Without a proactive plan, a significant portion of the wealth you have spent decades building can be lost to federal and state taxes.

This pillar is about anticipating and managing that liability. It is not about what an accountant does in April; it is about making strategic decisions years before a sale. This includes structuring the transaction in a tax-advantaged way and carefully considering the timing.

A well-structured exit is not just about the sale price you achieve. It is about the wealth you keep. Proactive tax planning is the critical discipline that bridges that gap.

After the sale, this focus continues. This pillar guides how your newfound liquidity is managed to build a durable, tax-efficient investment portfolio that is designed to grow your wealth while carefully managing your ongoing tax obligations.

Pillar 3: Retirement Income Design

This is where the plan becomes tangible. The lump sum from your business sale is not your retirement—it is the raw material.

This pillar involves the deliberate process of converting that capital into a predictable, sustainable income stream. A crucial component is designing a withdrawal strategy to fund your lifestyle for the next 20, 30, or more years without prematurely depleting capital.

We map out how to draw from different accounts—taxable brokerage, traditional IRAs, Roth accounts—to maintain a favorable tax position each year. The goal is simple: create a reliable "personal paycheck" that allows you to live the life you want without being distracted by market noise.

Pillar 4: Asset Protection and Estate Planning

The final pillar is about ensuring your wealth endures. It focuses on protecting your assets and directing them according to your wishes, securing your family and your legacy long after you are gone.

This involves integrating your business exit with your broader estate plan. It answers how wealth will be transferred to heirs, how you can fund charitable goals using tools like trusts, and how your assets are shielded from potential creditors or legal challenges. A key piece of any solid plan is safeguarding your assets, which includes understanding rights and protections for your 401k and other retirement accounts from unexpected claims.

For the multi-generational families we serve across Fulton and Forsyth counties, this pillar is fundamentally about stewardship. It is about putting the right legal and financial structures in place to ensure the wealth you created continues to be a source of opportunity for generations to come.

Many retirement plans are available, and the right one depends entirely on your business structure and goals. Here is a brief overview of common options.

Comparing Key Retirement Vehicles for Business Owners

| Retirement Plan | Primary Benefit | Best Suited For |

|---|---|---|

| SEP IRA | Simple to set up and maintain; high contribution limits. | Freelancers, sole proprietors, and small businesses with few or no employees. |

| SIMPLE IRA | Easy administration with a straightforward employee matching component. | Small businesses (under 100 employees) looking for an easy-to-manage employee benefit. |

| Solo 401(k) | Allows for both "employee" and "employer" contributions, maximizing savings. | Owner-only businesses (and a spouse) who want to save aggressively for retirement. |

| Defined Benefit Plan | Allows for substantial, tax-deductible contributions, accelerating retirement savings. | High-earning, established business owners close to retirement age. |

Choosing the right vehicle is a strategic decision that aligns your business operations with your personal retirement timeline.

Together, these four pillars create a complete and cohesive framework for a successful transition from dedicated business owner to a life of financial independence.

Navigating Your Business Exit: A Strategic Timeline

Selling or transferring ownership of your business is likely the most significant financial event of your life. For the families we work with in Alpharetta and across North Georgia, it represents the culmination of decades of hard work.

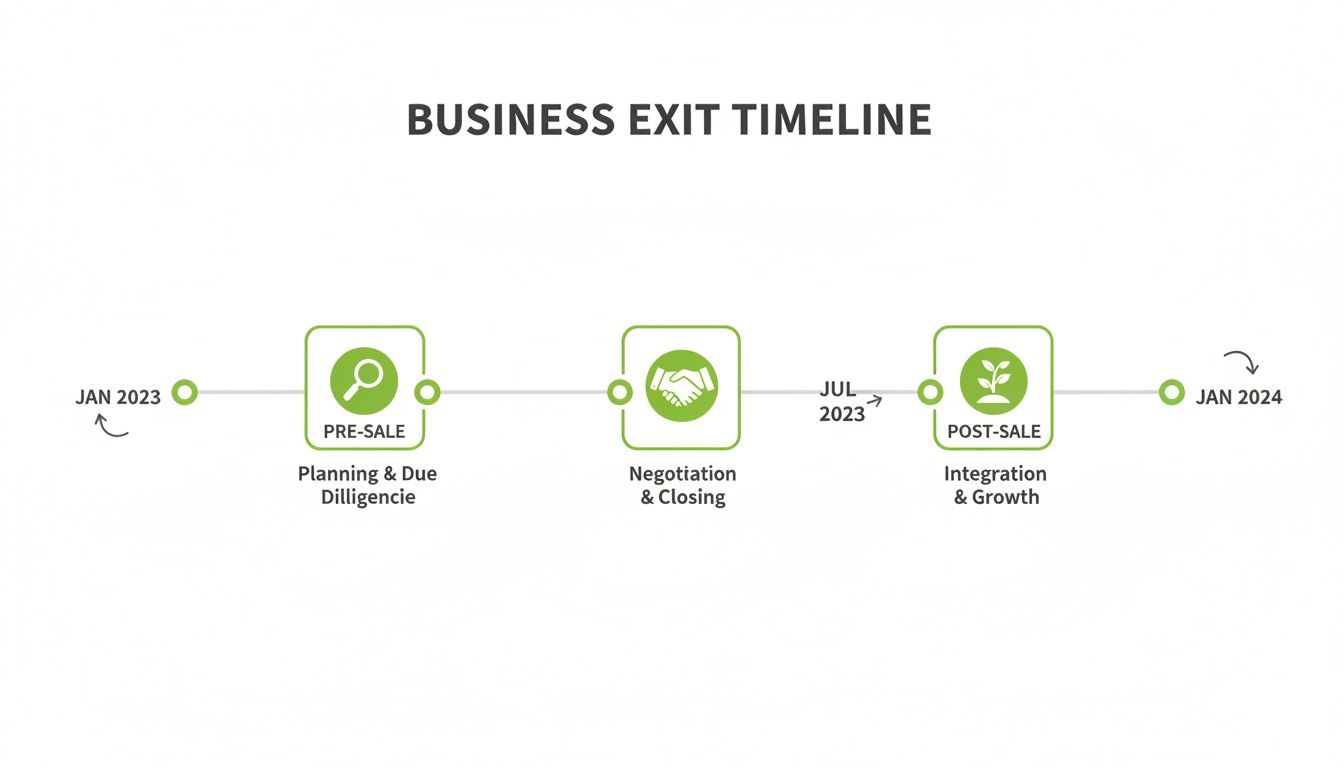

Viewing this as one overwhelming milestone can create unnecessary stress. It is far more effective to approach it as a series of manageable, strategic decisions laid out on a clear timeline.

This is not about a single event; it is about thoughtful preparation. A successful outcome is built years before a deal is ever signed.

The timeline below breaks down the key phases and actions that align your business exit with your personal retirement goals.

This visual demonstrates that a successful transition depends on distinct actions taken before, during, and after the sale. It reinforces the need for a long-term, coordinated strategy.

The Pre-Sale Phase (3-5+ Years Out)

This is where the most critical work is done. The planning you do here has the greatest impact on your final outcome, laying the groundwork to maximize your company’s value and prepare you personally for the next chapter.

Key actions during this phase include:

- Obtain a Formal Valuation: An independent, professional valuation provides a realistic baseline. Every other element of your financial plan flows from this number.

- Organize Financial Records: This means cleaning up your books and separating personal from business expenses. You want financial statements that are clear, transparent, and easily understood by a potential buyer.

- Assemble Your Advisory Team: You need a fiduciary wealth manager, a CPA, and a transaction attorney working in coordination to protect your interests.

This is also the time to begin tax mitigation planning. Decisions made years before a sale can dramatically change how much capital you ultimately retain. A crucial piece of the puzzle is understanding the legal side of transferring business ownership, a process best started with expert guidance well in advance.

The At-Sale Phase (The Year of Transaction)

During the year of the sale, the focus shifts from preparation to execution. Coordination between your advisors becomes absolutely critical as you navigate due diligence, negotiations, and closing.

This stage is intense and detail-oriented. The goal is simple: ensure the deal structure aligns with the tax and legacy plans you have already established. Every decision has a direct impact on your post-sale financial life.

The Post-Sale Phase (The First 5 Years of Retirement)

Once the transaction is complete, your role changes. You have transitioned from running an active business to managing a diversified investment portfolio. Your new responsibility is to act as the steward of your family’s liquid wealth.

Immediate priorities include:

- Execute the Investment Strategy: The sale proceeds are invested according to a plan designed long ago—one aligned with your goals for income, growth, and preservation.

- Implement a Sustainable Withdrawal Plan: Your wealth manager helps create a reliable "personal paycheck" from your portfolio to fund your lifestyle without eroding your principal.

- Revisit Estate and Legacy Plans: With your net worth now liquid, it is essential to update your estate documents to reflect your new financial reality and ensure your legacy goals are secure.

Failing to plan is the greatest risk of all. A startling 20% of small business owners admit to having nothing saved for retirement, and most have less than $50,000. This highlights the danger of viewing the business as the only retirement plan. A deliberate, multi-year exit timeline is not a luxury; it is a necessity for securing your future.

Connecting Your Business Exit to Your Family's Legacy

Wealth decisions are rarely just about the numbers on a balance sheet. At their core, they are about people—your family, your community, and the future you hope to create long after you have stepped away from the business.

A well-executed business exit is the most powerful tool an entrepreneur has to fund this vision. It is the financial event that can transform business success into a lasting family legacy.

Beyond the Balance Sheet to Generational Impact

For the families we serve in communities from Roswell to Cumming, retirement planning is deeply connected to their estate and philanthropic goals. The proceeds from a business sale are not just for funding a comfortable life; they are often the cornerstone of multi-generational wealth.

This requires a shift in perspective. The conversation moves from "How much is my business worth?" to "What do we want this wealth to accomplish for our family and our community?"

A thoughtfully planned exit can become the catalyst for significant goals:

- Funding Philanthropic Passions: Establishing a charitable trust or private foundation to support causes that are meaningful to your family.

- Securing Future Generations: Structuring trusts to provide for the education, health, and well-being of children and grandchildren in a responsible way.

- Preserving Family Harmony: Creating a clear, fair plan for wealth distribution that minimizes the potential for future conflict.

True legacy planning is not just about transferring assets; it is about transferring values. A successful business exit provides the financial engine, but clear family communication ensures the legacy endures.

The Importance of Coordinated Family Conversations

One of the most critical, yet often overlooked, aspects of legacy planning is open communication. Bringing family members into the conversation at the right time, guided by a trusted advisor, is essential.

These facilitated discussions are designed to align expectations and ensure everyone understands the "why" behind the financial decisions. This proactive approach helps prevent misunderstandings and preserves family relationships—the most valuable assets of all. The stress of ambiguity can be significant, and our work often focuses on reducing the hidden cost of financial uncertainty for the families we serve.

Statistics on family business transitions underscore this need. Only about 40% of U.S. family-owned businesses successfully transition to the second generation, and a mere 13% make it to the third. A primary reason for this is often the lack of a clear, communicated plan that addresses both the financial and emotional aspects of the transition.

Integrating your business exit strategy with your estate and legacy goals is not an afterthought. It is a central component of comprehensive retirement planning. It ensures the wealth you have worked so hard to build serves its ultimate purpose: providing lasting security, opportunity, and impact for the people and causes you care about most. This elevates the entire process from a simple transaction to a profound act of stewardship.

Your Partner for Comprehensive Retirement Planning

A successful retirement transition for a business owner is not a solo endeavor.

It is the result of a deliberate, coordinated effort that integrates every component of your financial life—your business, your investments, your tax situation, and your family’s future. Navigating this complexity requires more than just advice; it demands a strategic partnership.

This is the work we do for families in Alpharetta, Marietta, and across North Georgia. We bring all the essential disciplines together, ensuring your financial plan is built with the complete picture in mind from day one.

An Integrated Team for a Singular Purpose

Your financial life has many moving parts. An effective plan requires that your investment strategy informs your tax strategy, and that both align with your estate and legacy goals. When these elements are managed in separate silos, significant opportunities can be missed and unexpected risks can emerge.

Our approach is built around providing unified guidance. With CERTIFIED FINANCIAL PLANNER™ professionals and CPAs on our team, we address the entire picture. This structure is designed to deliver:

- Clarity: You understand the "why" behind every recommendation.

- Coordination: Your tax, investment, and estate plans work in harmony, not in conflict.

- Confidence: You can move forward knowing your strategy is resilient and fully aligned with your personal vision.

The ultimate goal of a wealth plan is peace of mind. It is the confidence that comes from knowing your life's work is secure and will continue to provide for your family for generations.

A Fiduciary Commitment to Your Future

Every decision we help you make is guided by a simple, powerful principle: your best interests must always come first.

As a fiduciary, our legal and ethical obligation is to you and your family alone. We believe this is the only foundation for a lasting advisory relationship. You can learn more about what a fiduciary wealth advisor actually does and why this commitment is so essential.

If the challenges and opportunities described in this guide resonate with you, we invite you to begin a thoughtful planning discussion. Let’s explore whether our approach to wealth management aligns with your long-term goals for your business, your wealth, and your family.

Common Questions from Business Owners

As an entrepreneur, you are accustomed to having the answers. But when it comes to exiting your life's work, the questions can feel complex. Here are a few we often hear from business owners in our communities across Alpharetta, Roswell, and North Georgia.

When should I start retirement planning?

The ideal time to begin is sooner than you might think.

A runway of at least five to ten years before your planned exit provides the greatest strategic advantage. This timeframe is not just about saving; it is about positioning. It allows you to intentionally maximize your company's value, implement tax-efficient structures, and ensure your personal and business finances are fully aligned.

Starting early creates options. It allows you to weather a market downturn or a personal challenge without being forced into an unfavorable transaction. However, if your timeline is shorter, a focused plan is still essential. A skilled advisor can help prioritize the most critical actions to protect your outcome.

How do I determine what my business is really worth?

This is not a time for guesswork or industry rules of thumb. To properly plan for retirement, you need a formal, independent valuation from a qualified professional. It is the only way to establish a credible number upon which to build your future.

A simple calculation based on profit multiples overlooks the complete picture. A professional valuation provides a much deeper analysis, examining factors such as:

- Consistent cash flow and profitability—not just a single strong year.

- The tangible and intangible assets you have built.

- Your market position relative to competitors.

- Defensible growth potential.

This number is not just for a potential buyer. It is the foundational figure for your entire retirement, estate, and legacy strategy.

An accurate business valuation is the cornerstone of your family's financial future. Basing your retirement on an assumption is a risk that successful entrepreneurs are typically unwilling to take.

What is the role of a fiduciary wealth manager during a business sale?

Think of your fiduciary wealth manager as your personal CFO throughout this transition. Their role is to sit on your side of the table, ensuring every decision—from deal structure to timing—serves your long-term retirement objectives.

This role is distinct from that of other professionals involved. Your M&A advisor and attorneys are focused on a singular goal: getting the deal done. Your fiduciary advisor is focused on what happens to you and your family the day after the deal is done.

They coordinate with your CPA on tax implications. They model how your financial life will look under different sale outcomes. They design the investment plan to convert a one-time liquidity event into a sustainable income stream for the rest of your life. Their sole agenda is your financial well-being, providing a crucial counterbalance to the purely transactional focus of the sale itself.

At Jamison Wealth Management, we provide the integrated guidance business owners need to navigate this critical transition with confidence. If you are ready to begin a thoughtful planning discussion, we invite you to schedule a confidential meeting with our team.